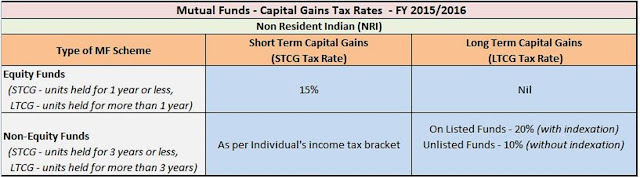

If you are an NRI and investing in Mutual funds in India, here are a couple of things you should know. 1) NRIs are allowed to invest in mutual funds in India on a repatriable or non-repatriable basis. Based on which…

Read more

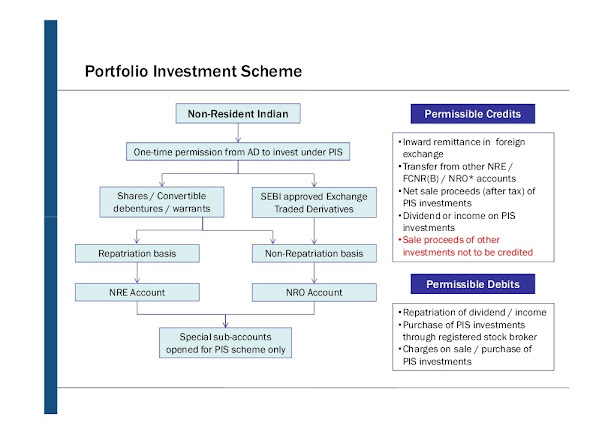

Hello guys, if you are interested in buying shares or doing trading on Indian stock exchanges like Bombay Stock Exchange BSE and National Stock Exchange NSE then you may hear about Portfolio Investment Scheme. RBI has allowed NRI…

Read more

There is no doubt that in today's expensive world you need a good health insurance policy for your family and parents. Hospitalization and Medical cost have risen significantly in India and expenditure ranging from 5 l…

Read more

If you have recently moved overseas from India and wondering should you open an NRI account or not then you should read this article. Do I receive questions like why should I open an NRI account? Is it mandatory for NRI to open …

Read more

No, you cannot deposit Indian rupees into an NRE account . Th e only way to fund an NRE account is via foreign currency remittance , foreign currency deposit when you visit India, or via foreign currency traveler's cheque. S…

Read more

One of the frequently asked questions from NRIs, who has just opened an NRE (Non Resident External) account is how to fund their NRE accounts In India? Since you cannot transfer Indian rupees from your normal savings account in…

Read more

As an India citizen, it's important for an NRI to know it's rights and responsibilities, especially about finance, tax, banking, and investments. When I first moved abroad I have absolutely zero knowledge of any of these…

Read more

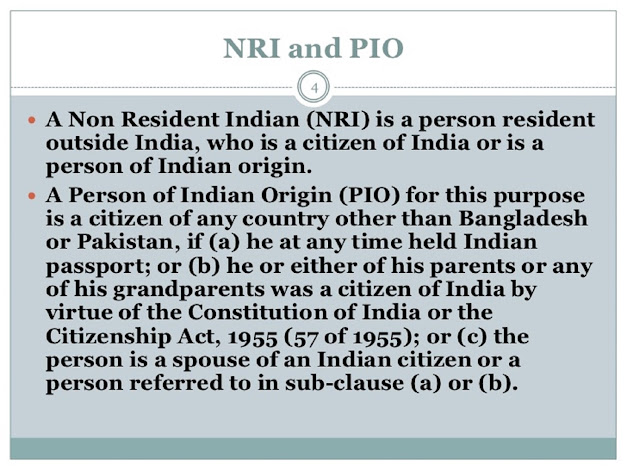

Though both NRI and POI are used to refers Indians living and working abroad and they have more or less similar rights to open a bank account , buy properties in India and restrictions e.g. not allowed to buy agriculture lands,…

Read more

If you know, NRIs are allowed to invest in Stock Market in India i.e. they can purchase and sell shares in Stock Exchanges (Secondary Market) as well as they can buy stocks on Initial Public Offering (IPO), the Primary Market. …

Read more

If you are an Indian staying in Singapore and want to open NRE or NRO account with Indian banks like SBI, Kotak, HDFC, ICICI, Yes Bank, Axis Bank, or a foreign bank with Indian operations like DBS bank, then you have a couple of…

Read more

As the name suggests, Resident Fixed deposits are for Residents of India and NRI fixed deposits are for Non-resident Indians but remember both are for Indian Citizens. Indian banks, both private banks e.g. ICICI, HDFC, Kot…

Read more

NRIs (Non Resident Indian) are allowed to open bank accounts in India, and by knowing features and the tax benefit of different types of NRI accounts, you can save the right amount of money. There are three types of accounts an…

Read more

Yes, both NRIs and Resident can remit the money obtained by selling properties in India, but you have to take a couple of things in your mind. For example, the sale proceeds amount must be deposited into NRO account , it cannot …

Read more

One of the common doubt among NRI community is whether they are eligible for Aadhaar Card or not. The doubt has created more worry with the recent announcement of the Indian government that Aadhaar will be mandatory for filing i…

Read more

NRE Fixed deposits are one of the best options for NRIs. It's safe, offer fixed and good returns and most importantly interest earned on NRE fixed deposit are not taxable in India . On top of that, you can also repatri…

Read more

When a Resident Indian becomes an NRI he needs to convert his Resident saving account to NRO account as per Indian banking and income tax laws e.g. FEMA. The NRO account provides the simplest way to access and operate the money …

Read more

You can send money abroad on your overseas savings account from an NRE account in India. You can do this both online from the comfort of your office or home and offline from any branch of your bank. This is also known as repatr…

Read more

You can use Western Union's money transfer facility If you are sending money to your parents or relatives in India, who are not used to modern banking and don't have any internet banking or simply a bank account. The Wes…

Read more

Many of my NRI readers ask me frequently, should I open an NRI saving account in India? Is it must for an NRI to open NRE or NRO account? Can I continue my existing Saving account in India? etc. Well, If you are going abroad f…

Read more

It's that time of the year again when every NRI starts to worry about their income tax filing in India. Thankfully, due to technological advancements, now NRIs can file income tax online with their comfort of office and hom…

Read more

![Is it Mandatory to Open NRI Accounts for Indians Living Abroad? [Answered]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg5M2c2PV15zbUNuzMTb8bZQXvYeAr7JjD60G88lOZDatljK3zXbQFx7WPOzz-qIKi-IdXQD3QHo6eyn430dXiQeRy6l_3iQ4kPNnAtx5VyR9XK7LOlH1Q6xjXjeTfHey31zggP-kScMlg/w588-h331/Is+it+mandatory+to+open+NRI+accounts+for+Overseas+Indian.png)

![How to Send Money Abroad/Overseas from NRE or Resident Bank Account - [Online Outward Repatriation]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjzoGjHqy8LkY8kA5iiRF5_6qkjmVqqSod0_8lTSDuyP_zGK4RUrqYyLGiWIX_WeD2GqkfRUoOJC7t4eEeU-3kShtfRwYCDBAIyexriVb7ZyqIRltfTmM4cmrqBYjDtA4KUHjX4gWSB4VU/s1600/OUTWARD+Remittance+Limit+for+Indians.jpg)