It's that time of the year again when every NRI starts to worry about their income tax filing in India. Thankfully, due to technological advancements, now NRIs can file income tax online with their comfort of office and home. Nevertheless, filing Income tax returns is not an easy job and there are some key things which every NRI should remember about income tax, filing returns, tax saving, deductions, and exceptions, etc. In this article, I'll share 10 of such things, which is useful for every Indian living abroad, particularly for those who have recently migrated to overseas from India, like a young software engineer from Infosys or TCS.

10 Deduction NRIs can benefit and Pay less Tax in India

Without wasting anymore of your time, here is a list of 10 deduction NRIs enjoy in India. You can use these deduction to reduce your taxable income and save money. Less taxable income means less tax to pay.1) Is Income Tax Payment Mandatory for NRIs

Income tax filing is not mandatory for NRIs if total income earned in India is less than 2.5 lacs without any deduction under section 80C and 80U. Though you need to remember that tax on NRE fixed deposit is not counted against your taxable income.

You can further check this article to find out what you need to consider while calculating your income tax return and when exactly you need to file an income tax return in India.

2) Deductions under section 80C

Like Resident taxpayers, NRIs can also take advantage of deductions of up to 1.5 lacs under section 80C from their gross total income. Following deductions under section 80C are allowed to NRIs

2.1 Life Insurance Premium Payment:

The policy must be in the NRI's name or in the name of their spouse or any child's name (child may be dependent/independent, minor/major r, or married/unmarried). The premium must be less than 10% of the sum assured.

2.2 Children's Tuition Fee Payment:

Tuition fees paid to any school, college, university or other educational institution situated within India for the purpose of full-time education of any two children (including payments for play school, pre-nursery and nursery).

2.3 Principal Repayments on loan for the purchase of house property:

A deduction is allowed for repayment of loan taken for buying or constructing residential house property. Also allowed for stamp duty, registration fees and other expenses for purpose of transfer of such property to the NRI.

2.4 ULIPS or Unit Linked Insurance Plan:

ULIPS sold with life insurance cover for deduction under Section 80C. Includes Contribution to Unit Linked Insurance Plan of LIC Mutual Fund like Dhanraksha 1989 and contribution to Other Unit Linked Insurance Plan of UTI.

2.5 Investments in ELSS

I have already written about it, you can check this article here.

3) Deduction on Home loan EMI interest for NRIs

NRIs can claim all the deductions available to a resident from Income from House Property for a house purchased in India. Deduction towards property tax paid and interest on home loan deduction is also allowed.

4) Deduction for the Premium paid for health insurance under Section 80D

NRIs are allowed to claim a deduction for premium paid for health insurance. This deduction is available up to Rs.20,000 for senior citizens and up to Rs. 15,000 in other cases for insurance of self, spouse and dependent children.

Additionally, an NRIs can also claim a deduction for insurance of parents(father or mother or both) up to 20,000 if their parents are a senior citizen and Rs. 15,000 if the parents are not senior citizens.

Therefore, an NRI will be able to claim a maximum deduction of Rs. 40,000 under this section. Beginning FY 2012-13, within the existing limit a deduction of up to Rs. 5,000 for preventive health check-ups is also available.

5) Deduction of interest paid on an education loan under Section 80E

Similar to resident taxpayers, NRIs can also claim a deduction for education loan interest from total taxable income. This loan may have been taken for higher education for the NRI, or NRI's spouse or children or for a student for whom the NRI is a legal guardian.

There is no limit on the amount which can be claimed as a deduction under this section. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier. A deduction is not available on the principal repayment of the loan

If this option is not suitable for you then you can also check this article to learn more options on section 80E for tax saving.

6) Deduction on donations for social causes under Section 80G

NRIs are allowed to claim the tax deduction on donations for social causes under Section 80G e.g. if you donated some money to Prime Minister's National Relief Fund for Chennai flood or another calamity, you can claim a deduction of that amount in your taxable income.

Remember not all donations are subject to 100% deductions, some give 50% deduction and some given only a 10% deduction.

Here are some of the donations Donations with 100% deduction without any qualifying limit:

7) Deduction of interest on savings bank account under Section 80TTA

Non-resident Indians can claim a deduction on income from interest on savings bank account up to a maximum of Rs. 10,000 like Resident Indians. This is allowed on deposits in a savings account (not time deposits) with a bank, co-operative society or post office and is available starting FY 2012-13.

8) DTAA

I have already written about it, see here.

9) Additional 50K Tax deduction on NPS apart from 80C

NRIs can now save tax by investing in the National Pension Scheme. This will also come under 80C 1.5 lacs limit but apart from that NPS also allows both NRIs and resident to claim additional 50K INR deduction in taxable income. See here to learn more about NPS for NRIs.

That's all about some important things related to income tax every NRI should be aware of. If you have anything to add into this list just drop a note and I'll add it. If you have any doubts or questions regarding any of these tax saving options like whether you are eligible or not, please drop a note.

Other NRI Income tax articles you may like

Thanks for reading this article so far, if you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.

Income tax filing is not mandatory for NRIs if total income earned in India is less than 2.5 lacs without any deduction under section 80C and 80U. Though you need to remember that tax on NRE fixed deposit is not counted against your taxable income.

You can further check this article to find out what you need to consider while calculating your income tax return and when exactly you need to file an income tax return in India.

2) Deductions under section 80C

Like Resident taxpayers, NRIs can also take advantage of deductions of up to 1.5 lacs under section 80C from their gross total income. Following deductions under section 80C are allowed to NRIs

2.1 Life Insurance Premium Payment:

The policy must be in the NRI's name or in the name of their spouse or any child's name (child may be dependent/independent, minor/major r, or married/unmarried). The premium must be less than 10% of the sum assured.

2.2 Children's Tuition Fee Payment:

Tuition fees paid to any school, college, university or other educational institution situated within India for the purpose of full-time education of any two children (including payments for play school, pre-nursery and nursery).

2.3 Principal Repayments on loan for the purchase of house property:

A deduction is allowed for repayment of loan taken for buying or constructing residential house property. Also allowed for stamp duty, registration fees and other expenses for purpose of transfer of such property to the NRI.

2.4 ULIPS or Unit Linked Insurance Plan:

ULIPS sold with life insurance cover for deduction under Section 80C. Includes Contribution to Unit Linked Insurance Plan of LIC Mutual Fund like Dhanraksha 1989 and contribution to Other Unit Linked Insurance Plan of UTI.

2.5 Investments in ELSS

I have already written about it, you can check this article here.

3) Deduction on Home loan EMI interest for NRIs

NRIs can claim all the deductions available to a resident from Income from House Property for a house purchased in India. Deduction towards property tax paid and interest on home loan deduction is also allowed.

4) Deduction for the Premium paid for health insurance under Section 80D

NRIs are allowed to claim a deduction for premium paid for health insurance. This deduction is available up to Rs.20,000 for senior citizens and up to Rs. 15,000 in other cases for insurance of self, spouse and dependent children.

Additionally, an NRIs can also claim a deduction for insurance of parents(father or mother or both) up to 20,000 if their parents are a senior citizen and Rs. 15,000 if the parents are not senior citizens.

Therefore, an NRI will be able to claim a maximum deduction of Rs. 40,000 under this section. Beginning FY 2012-13, within the existing limit a deduction of up to Rs. 5,000 for preventive health check-ups is also available.

5) Deduction of interest paid on an education loan under Section 80E

Similar to resident taxpayers, NRIs can also claim a deduction for education loan interest from total taxable income. This loan may have been taken for higher education for the NRI, or NRI's spouse or children or for a student for whom the NRI is a legal guardian.

There is no limit on the amount which can be claimed as a deduction under this section. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier. A deduction is not available on the principal repayment of the loan

If this option is not suitable for you then you can also check this article to learn more options on section 80E for tax saving.

6) Deduction on donations for social causes under Section 80G

NRIs are allowed to claim the tax deduction on donations for social causes under Section 80G e.g. if you donated some money to Prime Minister's National Relief Fund for Chennai flood or another calamity, you can claim a deduction of that amount in your taxable income.

Remember not all donations are subject to 100% deductions, some give 50% deduction and some given only a 10% deduction.

Here are some of the donations Donations with 100% deduction without any qualifying limit:

- Prime Minister's National Relief Fund

- National Defence Fund set up by the Central Government

- National Foundation for Communal Harmon

- Swachh Bharat Kosh (applicable from the financial year 2014-15)

- Clean Ganga Fund (applicable from the financial year 2014-15)

7) Deduction of interest on savings bank account under Section 80TTA

Non-resident Indians can claim a deduction on income from interest on savings bank account up to a maximum of Rs. 10,000 like Resident Indians. This is allowed on deposits in a savings account (not time deposits) with a bank, co-operative society or post office and is available starting FY 2012-13.

8) DTAA

I have already written about it, see here.

9) Additional 50K Tax deduction on NPS apart from 80C

NRIs can now save tax by investing in the National Pension Scheme. This will also come under 80C 1.5 lacs limit but apart from that NPS also allows both NRIs and resident to claim additional 50K INR deduction in taxable income. See here to learn more about NPS for NRIs.

Tax Saving Options NOT Available to NRIs

Apart from that, you should also know that there are some tax-saving options which are only applicable to resident taxpayer and NRIs are not allowed to take advantage of that like:- Investment in PPF is not allowed.

- (NRIs are not allowed to open new PPF accounts, however, PPF accounts which are opened while they are a Resident are allowed to be maintained.)

- Investments in NSCs

- Post Office 5 Year Deposit Scheme

- Senior Citizen Savings Scheme.

- Deduction for investment on Sukanya Samriddhi Yojna Scheme are not allowed to NRI because they are not eligible to open SSY account for their daughter aged under 10 years old

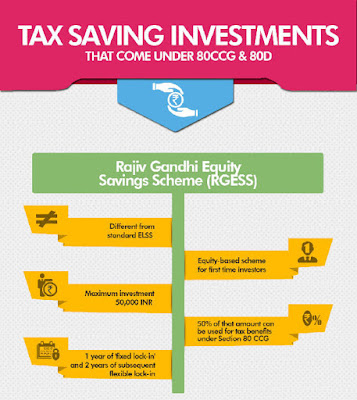

- Deduction under section 80CCG or Rajiv Gandhi Equity Savings Scheme is not allowed to NRI

That's all about some important things related to income tax every NRI should be aware of. If you have anything to add into this list just drop a note and I'll add it. If you have any doubts or questions regarding any of these tax saving options like whether you are eligible or not, please drop a note.

Other NRI Income tax articles you may like

- 3 Income tax benefits of opening NRI accounts in India

- 13 ways to save income tax in India

- 10 Income tax deductions and exemptions NRIs should know

- How NRIs can file their income tax returns online

- Is NRIs overseas income taxable in India

- How much TDS is deducted on NRO account?

- Is it mandatory to file income tax returns for NRIs?

- Is it mandatory for NRIs to declare foreign bank accounts on tax returns?

- How to determine tax residential status of NRIs?

- 10 points NRIs should know about Income tax?

- Is Aadhaar card Mandatory for filing an Income tax return for NRIs?

Thanks for reading this article so far, if you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.

In the point (6) above, Should I use only NRO accounts for donations (to claim exemptions for donations under 80G).

ReplyDeleteCan't NRE accounts be used?

I am not so sure, but I generally use NRO account for that purpose because that's the money which is taxable and hard to remit. I think you can still claim, but prefer NRO money for such thing.

Delete