If you are an NRI and investing in Mutual funds in India, here are a couple of

things you should know.

1) NRIs are allowed to invest in mutual funds in India on a repatriable or non-repatriable basis. Based on which type of investment you choose, there are certain rules to follow.

2) The investments carry the right of repatriation of capital invested and capital appreciation only till the investor remains an NRI.

3) If an investment is on a repatriable basis, the payment must be made from either an NRE account or the FCNR account of the investor. Investments on a non-repatriable basis can only be made by drawing payment instruments on the NRE/ FCNR/NRO account of the investor.

4) An overseas address is a mandatory field that requires being filled in the mutual fund application made by an NRI. You also need to provide the address proof which could be utility bills like telephone or internet bills, electricity, water bills, etc. A registered rent agreement should also be ok.

5) You need to submit KYC documents i.e. both ID and permanent address proof along with PAN number of open mutual fund account Indian.

6) Redemption proceeds (after deduction of taxes) are paid in rupees by cheque to the account number provided. Some banks also offer the direct credit of redemption proceeds to the NRE/NRO account. If investments are made on a non-repatriable basis, redemption proceeds shall be credited to the NRO account.

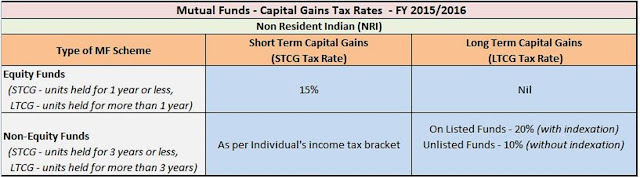

7) Tax is deducted at source on capital gains made on investments by NRIs. Investments in equity funds held over 1 year are exempt from tax and hence no tax is deducted at source, but for short-term capital gains are taxed at the rate of 15%.

For non-equity funds, a short-term capital gain is calculated if units are held for 3 years or less and long-term capital gain is applied if units are held for more than 3 years. For short-term capital gains, the tax rate is as per the Individual's income tax bracket, and for long-term capital gains, for listed funds, it's taxed at a rate of 20% with indexation, and for the unlisted fund, it's taxed at the rate of 10% without indexation.

A digitally signed TDS certificate is sent along with the redemption proceeds.

8) A power of attorney (POA) holder can open and operate a mutual fund account on behalf of an NRI. To operate the mutual fund account, the POA has to be registered with the mutual fund

That's all about some important points about investing in a mutual fund in India. NRI should take advantage of this provision and benefit from the growth offered by the Indian Stock market. Make sure you understand the investment type i.e. repatriable and non-repatriable basis because that's very important if you intend to remit money back overseas.

1) NRIs are allowed to invest in mutual funds in India on a repatriable or non-repatriable basis. Based on which type of investment you choose, there are certain rules to follow.

2) The investments carry the right of repatriation of capital invested and capital appreciation only till the investor remains an NRI.

3) If an investment is on a repatriable basis, the payment must be made from either an NRE account or the FCNR account of the investor. Investments on a non-repatriable basis can only be made by drawing payment instruments on the NRE/ FCNR/NRO account of the investor.

4) An overseas address is a mandatory field that requires being filled in the mutual fund application made by an NRI. You also need to provide the address proof which could be utility bills like telephone or internet bills, electricity, water bills, etc. A registered rent agreement should also be ok.

5) You need to submit KYC documents i.e. both ID and permanent address proof along with PAN number of open mutual fund account Indian.

6) Redemption proceeds (after deduction of taxes) are paid in rupees by cheque to the account number provided. Some banks also offer the direct credit of redemption proceeds to the NRE/NRO account. If investments are made on a non-repatriable basis, redemption proceeds shall be credited to the NRO account.

7) Tax is deducted at source on capital gains made on investments by NRIs. Investments in equity funds held over 1 year are exempt from tax and hence no tax is deducted at source, but for short-term capital gains are taxed at the rate of 15%.

For non-equity funds, a short-term capital gain is calculated if units are held for 3 years or less and long-term capital gain is applied if units are held for more than 3 years. For short-term capital gains, the tax rate is as per the Individual's income tax bracket, and for long-term capital gains, for listed funds, it's taxed at a rate of 20% with indexation, and for the unlisted fund, it's taxed at the rate of 10% without indexation.

A digitally signed TDS certificate is sent along with the redemption proceeds.

8) A power of attorney (POA) holder can open and operate a mutual fund account on behalf of an NRI. To operate the mutual fund account, the POA has to be registered with the mutual fund

That's all about some important points about investing in a mutual fund in India. NRI should take advantage of this provision and benefit from the growth offered by the Indian Stock market. Make sure you understand the investment type i.e. repatriable and non-repatriable basis because that's very important if you intend to remit money back overseas.

Other NRI Income tax articles you may like

- 3 Income tax benefits of opening NRI accounts in India

- 13 ways to save income tax in India

- 10 Income tax deductions and exemptions NRIs should know

- How NRIs can file their income tax returns online

- Is NRIs overseas income taxable in India

- How much TDS is deducted from the NRO account?

- Is it mandatory to file income tax returns for NRIs?

- Is it mandatory for NRIs to declare foreign bank accounts on tax returns?

- How to determine the residential tax status of NRIs?

- 10 points NRIs should know about Income tax?

- Is Aadhaar card Mandatory for filing an Income tax return for NRIs?

Thanks for reading this article so far, if you liked this article then please

share it with your friends and family on social media, Facebook, and

Twitter.