Hello guys, if you are interested in buying shares or doing trading on Indian stock exchanges like Bombay Stock Exchange BSE and National Stock Exchange NSE then you may hear about Portfolio Investment Scheme. RBI has allowed NRIs to invest in the Indian stock market by buying

shares/convertibles of listed Indian companies in recognized stock exchanges

e.g. BSE and NSE, under Portfolio Investment Scheme (PIS) with banks. Many NRI

doesn't know much about

Portfolio Investment Scheme, Even I didn't know about it some time back. Once I come to know about it I

have collected some useful information and I wanted to share that with you

guys.

Good knowledge of what you can do with a PIS account and what you cannot do with a PIS account is very important for NRIs, who are interested in investing in stocks of Indian companies like Infosys, TCS, HCL, Tech Mahindra on BSE or NSE. So, without wasting any more time, let's see some of the important features of the Portfolio Investment Scheme or PIS account.

2) NRIs are allowed to invest in exchange-traded derivatives like Futures and options. NRIs can execute futures/options etc. which are traded in the Stock Exchanges on the non-repatriation basis (through NRO SB PIS A/c.) only subject to SEBI approved limits.

3) NRIs are not allowed to have more than one bank as a designated bank for his PIS transactions. They have to deal with one bank only for PIS.

4) Even if NRI already has an NRE/NRO account, A separate NRE saving PIS for repatriable investments, and NRO saving PIS for non-repatriable investments have to be opened exclusively for the PIS transactions. No cheque books are issued in the account. A separate request for withdrawal/transfer/closure of the account is to be given.

5) NRIs can make Investments on a repatriation or non-repatriation basis. For investments under a repatriation basis, a separate NRE SB PIS account is opened by remittance from overseas/NRE/FCNR account. If the investments are on a non-repatriation basis, a separate NRO SB PIS account is to be opened by remittance from overseas or NRE, FCNR or NRO account or Local sources.

6) There is a limit on how much NRIs can invest in a stock. Investments in repatriation or non-repatriation shall be up to 5 % of the paid-up capital of the company for a single NRI. Aggregate Investments by all NRIs can not exceed 10 % of the paid-up capital of the company. The aggregate investments can be up to 24 % if the general body of the Indian company passes a special resolution to that effect. This limit is monitored by RBI on a daily basis and advises Banks if the limit is reached so that further investments shall not be allowed.

7) When a resident Indian becomes a non-resident, he can continue to hold the securities which he had purchased as a resident Indian, even after he has become a non-resident Indian, on a non-repatriable basis.

8) When an NRI becomes a resident it is required to change the status of holding from non-resident to resident. NRI has to inform the change of status to the designated authorized dealer branch, through which the investor had made the investments in Portfolio Investment Scheme and the DP with whom he/she has opened the Demat account. Subsequently, a new demand account in the resident status will have to be opened, securities should be transferred from the NRI Demat account to the resident account, and then close the NRI Demat account.

9) NRI can invest in IPO (Initial Public Offering) if the issuing company is issuing shares to NRI on the basis of specific or general permission from GoI/RBI. Therefore, individual NRI need not obtain any permission.

10) Last but probably most important thing is the tax implication of PIS investments. Currently, there is no long-term capital gain for the sale of shares through stock exchanges if the holding period is more than one year. If sold within one year of purchase, short-term capital gains will be deducted from the sale proceeds. TDS certificate will be issued by the bank to the NRI for the tax deducted.

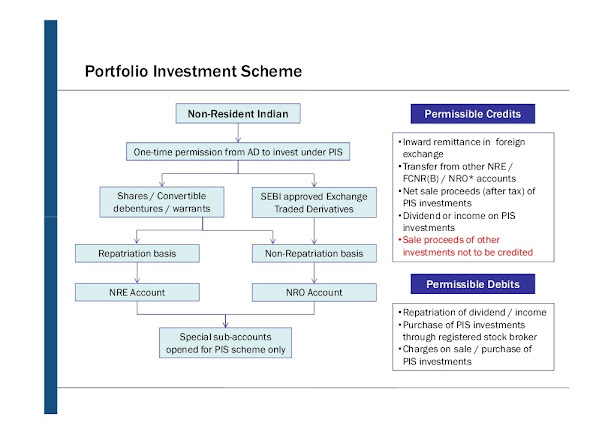

Here is a nice slide about how you NRI can make an investment from Portfolio Investment Scheme or PIS:

That's all about some important things about Portfolio Investment Scheme or PIS, every NRI, who is interested in investing in the Indian equity market should know. Just remember that you can make an investment on a repatriable and non-repatriable basis. For repatriation basis investment, the source of the fund must be NRE or FCNR account or remitted from abroad, but for non-repatriable investment, you can use funds from your NRO account as well.

Good knowledge of what you can do with a PIS account and what you cannot do with a PIS account is very important for NRIs, who are interested in investing in stocks of Indian companies like Infosys, TCS, HCL, Tech Mahindra on BSE or NSE. So, without wasting any more time, let's see some of the important features of the Portfolio Investment Scheme or PIS account.

10 Important Points about Portfolio Investment Scheme (PIS)

1) NRIs are not allowed to do day trading. NRIs have to take delivery of the shares and give delivery of the shares. Also, No short selling is allowed.2) NRIs are allowed to invest in exchange-traded derivatives like Futures and options. NRIs can execute futures/options etc. which are traded in the Stock Exchanges on the non-repatriation basis (through NRO SB PIS A/c.) only subject to SEBI approved limits.

3) NRIs are not allowed to have more than one bank as a designated bank for his PIS transactions. They have to deal with one bank only for PIS.

4) Even if NRI already has an NRE/NRO account, A separate NRE saving PIS for repatriable investments, and NRO saving PIS for non-repatriable investments have to be opened exclusively for the PIS transactions. No cheque books are issued in the account. A separate request for withdrawal/transfer/closure of the account is to be given.

5) NRIs can make Investments on a repatriation or non-repatriation basis. For investments under a repatriation basis, a separate NRE SB PIS account is opened by remittance from overseas/NRE/FCNR account. If the investments are on a non-repatriation basis, a separate NRO SB PIS account is to be opened by remittance from overseas or NRE, FCNR or NRO account or Local sources.

6) There is a limit on how much NRIs can invest in a stock. Investments in repatriation or non-repatriation shall be up to 5 % of the paid-up capital of the company for a single NRI. Aggregate Investments by all NRIs can not exceed 10 % of the paid-up capital of the company. The aggregate investments can be up to 24 % if the general body of the Indian company passes a special resolution to that effect. This limit is monitored by RBI on a daily basis and advises Banks if the limit is reached so that further investments shall not be allowed.

7) When a resident Indian becomes a non-resident, he can continue to hold the securities which he had purchased as a resident Indian, even after he has become a non-resident Indian, on a non-repatriable basis.

8) When an NRI becomes a resident it is required to change the status of holding from non-resident to resident. NRI has to inform the change of status to the designated authorized dealer branch, through which the investor had made the investments in Portfolio Investment Scheme and the DP with whom he/she has opened the Demat account. Subsequently, a new demand account in the resident status will have to be opened, securities should be transferred from the NRI Demat account to the resident account, and then close the NRI Demat account.

9) NRI can invest in IPO (Initial Public Offering) if the issuing company is issuing shares to NRI on the basis of specific or general permission from GoI/RBI. Therefore, individual NRI need not obtain any permission.

10) Last but probably most important thing is the tax implication of PIS investments. Currently, there is no long-term capital gain for the sale of shares through stock exchanges if the holding period is more than one year. If sold within one year of purchase, short-term capital gains will be deducted from the sale proceeds. TDS certificate will be issued by the bank to the NRI for the tax deducted.

Here is a nice slide about how you NRI can make an investment from Portfolio Investment Scheme or PIS:

That's all about some important things about Portfolio Investment Scheme or PIS, every NRI, who is interested in investing in the Indian equity market should know. Just remember that you can make an investment on a repatriable and non-repatriable basis. For repatriation basis investment, the source of the fund must be NRE or FCNR account or remitted from abroad, but for non-repatriable investment, you can use funds from your NRO account as well.

Other NRI Income tax articles you may like

- Is NRIs overseas income taxable in India

- How much TDS is deducted from the NRO account?

- Is it mandatory to file income tax returns for NRIs?

- Is it mandatory for NRIs to declare foreign bank accounts on tax returns?

- How to determine the residential tax status of NRIs?

- 3 Income tax benefits of opening NRI accounts in India

- 13 ways to save income tax in India

- 10 Income tax deductions and exemptions NRIs should know

- How NRIs can file their income tax returns online

- 10 points NRIs should know about Income tax?

- Is Aadhaar card Mandatory for filing an Income tax return for NRIs?

Thanks for reading this article so far, if you liked this article then

please share it with your friends and family on social media, Facebook, and

Twitter.

can NRI investors invest in unlisted companies? if yes, can it be via NRO SB PIS account?

ReplyDeleteHow to transfer Equity share certificate(paper)held before being an NRI to current NRI status PIS account - tx - Maxie

ReplyDeleteWhat is the difference between NRO SB PIS and NRE SB PIS?

ReplyDelete