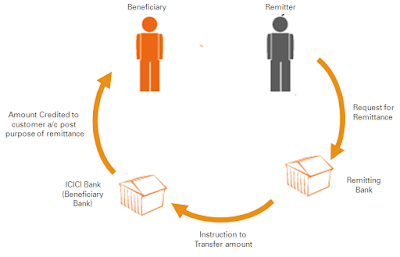

One of the frequently asked questions by people going abroad is that, whether they can send money to a resident saving account in India or not? Will that be taxable? The answer to this question depends upon whose resident …

Read more

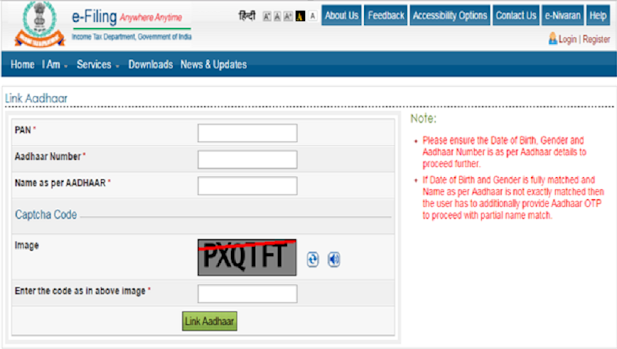

Based upon my knowledge, Aadhar Card is mandatory for filling income tax return this year for all resident Indians . They even need to link their PAN Card to Aadhar card before filling income tax returns, but for NRIs, Aadhar car…

Read more

TDS stands for Tax deducted at source, is income tax levied on interest earned by Fixed deposits. The rate on which TDS is applied varies, depending upon, whether the Fixed deposit is with a bank, a company or the post office.…

Read more

One of the most common doubts among every new NRIs mind is whether they need to file income tax returns in India or not. As I told earlier that it's not mandatory to file an income tax return in India , but now questions co…

Read more

Many NRIs buy property in India by taking NRI home loans, but when it comes to tax saving, most of them are not sure whether they are eligible for any tax saving in India or not. They just earned in abroad and replay the home lo…

Read more

One of the bad thing about Fixed deposits are TDS, i.e., tax deducted at source. If you don't pay attention to TDS or doesn't do enough to prevent or avoid TDS, you could lose the right amount of your interest income to …

Read more

NRIs (Non Resident Indian) are allowed to open bank accounts in India, and by knowing features and the tax benefit of different types of NRI accounts, you can save the right amount of money. There are three types of accounts an…

Read more

Many NRIs are not aware of income tax laws in India and doesn't know whether they have to file income tax returns in India or not. Sometimes they also wonder, do they have to include income earned in the USA as well or only …

Read more

Yes, both NRIs and Resident can remit the money obtained by selling properties in India, but you have to take a couple of things in your mind. For example, the sale proceeds amount must be deposited into NRO account , it cannot …

Read more

One of the common doubt among NRIs who are filing their income tax returns in India is to whether to declare foreign bank accounts and assets or not . I often receive comments and questions whether it's mandatory for an NRI …

Read more

Does it necessary for NRI to File Income Tax Return in India? One of the most common doubt every NRI has is whether its mandatory for them to file incomes tax return in India or not? Short answer is, it depends . If you are a…

Read more

Many of my NRI readers ask me frequently, should I open an NRI saving account in India? Is it must for an NRI to open NRE or NRO account? Can I continue my existing Saving account in India? etc. Well, If you are going abroad f…

Read more

It's that time of the year again when every NRI starts to worry about their income tax filing in India. Thankfully, due to technological advancements, now NRIs can file income tax online with their comfort of office and hom…

Read more

It's that time of the year again when every India taxpayer (including those who lives abroad) start to worry about filling your income tax in India. Like previous year, 31st July is the last date to file your income tax ret…

Read more

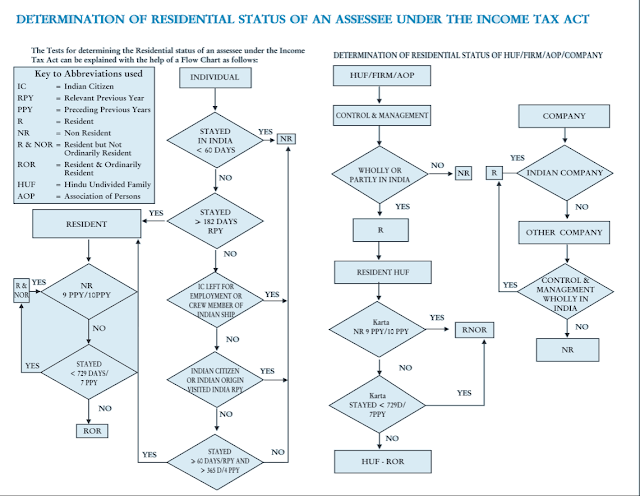

Whether the global income of NRI is taxable or not depends on NRI's residential status in India for that financial year e.g. from 1st April to 31st March. If NRI's tax status is "resident" in the financial ye…

Read more

Hello guys, if you are wondering whether interested earned on NRO saving account or NRO fixed deposit is taxable in India or not then you are at the right place. Yes , unlike interest earned on both NRE saving account and NRE fi…

Read more

NRIs are always in doubt with taxation and many times they end up by paying double tax on same income, both in the foreign country they are currently working and staying and on India. In order to avoid this double taxation of in…

Read more

Let me answer the second question first to convince you why a returning NRI would like to find out whether he is a resident or a non-ordinarily reside (RNOR)? Well, there is big tax benefit of filing income tax return in India …

Read more

One of the important question among Indians going abroad or NRIs returning from overseas to India for a good is to check their residential status to see whether they qualify as an NRI, an RNOR or an Ordinary Indian Resident in …

Read more

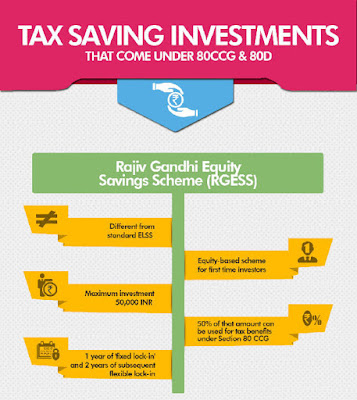

If you have been filing your income tax returns in India then you know that there are a lot of tax saving options you can use to claim tax deductions and exemptions under a various section of income tax law of India. For examp…

Read more