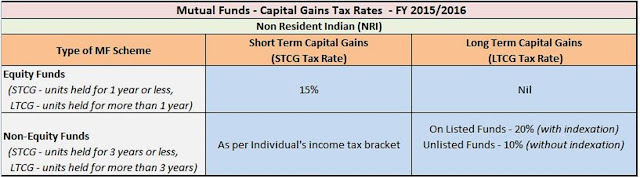

If you are an NRI and investing in Mutual funds in India, here are a couple of things you should know. 1) NRIs are allowed to invest in mutual funds in India on a repatriable or non-repatriable basis. Based on which…

Read more

As the financial year proceeds to end, many of my colleagues and friends started thinking about tax saving though I have always suggested them to do it in a planned way from the start of the year it never happened. Since we all k…

Read more

ELSS (Equity Linked Saving Scheme), PPF (Public Provident Fund), NSC (National Saving Certificate), and Tax-saving fixed deposits with banks are four of the most popular way to save tax under section 80C , but which one is the …

Read more

It's this time of the year when most of the salaried Indian think for tax saving investments. Most of the income taxpayers know about section 80C and the 1.5 lakh tax deductions it allows into your taxable income, but do you…

Read more

Good News for all income taxpayers of India, including NRIs and PIOs who pay income tax in India. Now, they can reduce additional 50 Thousand INR on taxable income by investing in the National Pension System (NPS) for the finan…

Read more

Online PPF Account with SBI and ICICI bank India Now you can open PPF or Public Provident Fund account online in India with ICICI bank and State Bank of India (SBI). This is a major step to increase popularity of PPF or Public …

Read more

Many people so much effort to earn money, but they don't put even 10% of that to save money from taxes and expenditure. In my post 10 ways to save money , I have talked about some general saving tips, now here you will learn…

Read more

With Rupee falling every day and touching a new all-time low of almost $1 to Rs 83, many of NRI Indians are asking this question, is it a right time to transfer money to India or is it the right time to invest in FCNR deposits …

Read more

PM Modi has launched several good financial schemes e.g. Atal Pension Yojna to provide retirement solutions to many peoples from un-organized sector, PradhanMantri Jan Dhan yojana to open bank accounts for poor, Pradhan Mantri …

Read more

One of the bad thing about Fixed deposits are TDS, i.e., tax deducted at source. If you don't pay attention to TDS or doesn't do enough to prevent or avoid TDS, you could lose the right amount of your interest income to …

Read more

NRIs (Non Resident Indian) are allowed to open bank accounts in India, and by knowing features and the tax benefit of different types of NRI accounts, you can save the right amount of money. There are three types of accounts an…

Read more

If you are an NRI and have income in India like rental income and your annual income is more than 2.5 lakh, the basic exemption limit then you can reduce your taxable income by investing in an NRO tax saver fixed deposit . NRO t…

Read more

Hello guys, if you are looking for a long-term, tax-saving option to put your hard-earned income then you have come to the right place. While there are a lot of tax-saving options available to NRIs and Indians in India the…

Read more

In my last post, can NRI invest in National Pension Scheme , I told you that NRIs are now allowed to open NPS accounts , it's time to share more information about NPS like why an NRI should invest in National Pension Scheme.…

Read more

Since the last date of the financial year 31st, March is approaching, many Mutual funds, brokerage house, and Insurance companies are aggressively promoting their products in a bid to attract income taxpayers who like to save ta…

Read more