Based upon my knowledge, Aadhar Card is mandatory for filling income tax return this year for all resident Indians. They even need to link their PAN Card to Aadhar card before filling income tax returns, but for NRIs, Aadhar card is not mandatory for filling income tax return. If you remember, NRIs need to file IT return if they have any income in India, even though it is not mandatory for NRIs to file income tax returns, especially if they have only income from Fixed deposits and Equity investment where TDS is already deducted, its advised that they file income tax return every year. It has many benefits but most important is that you will get your money back which is deducted as TDS if your total income is less than 2.5 lakh.

Many of my NRI friends and colleagues have been asking me this question from last a couple of weeks that I am an NRI and I don't have Aadhaar card, what should I do? Does Aadhar card be mandatory for filling income tax return on 2017?

Well, it's mandatory for resident Indians to link their Aadhaar card with PAN Card but NRIs or Indians, who are living abroad for more than six months (182 days to be exact) in the last 12 months, are not required to furnish Aadhar card detail in their income tax return, if they don't have Aadhaar yet.

In other words, NRIs are exempted from Aadhar card and PAN linking as well. But if you have an Aadhaar card, it’s a good idea to link it anyway now. You can link your Aadhar Card with PAN card online on the income tax website.

Step 1:

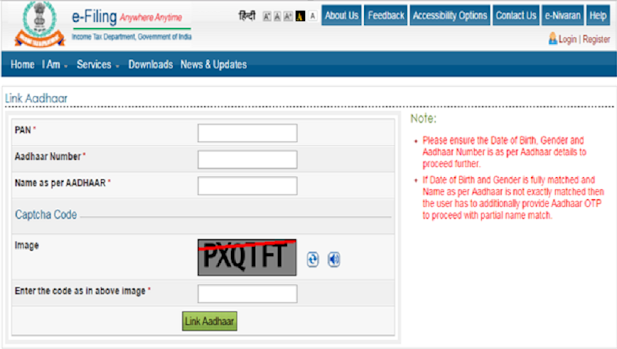

Just go to www.incometaxindiaefiling.gov.in and click on the link on the left pane – Link Aadhaar

Step 2:

Provide PAN, Aadhaar no. and enter your name as given in Aadhar card (avoid spelling mistakes) and submit. After verification from UIDAI which is the government website for Aadhaar and maintains all your personal data, the linking will be confirmed.

In the case of any minor mismatch in the name provided in Aadhaar card, an Aadhaar OTP will be required. Please ensure that the date of birth and gender in PAN and Aadhaar are exactly same.

In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and the taxpayer will be prompted to change the name in either Aadhaar or in the PAN database.

Btw, The Indian government has exempted Non- Resident Indians (NRIs) from the requirement of quoting Aadhaar card number while filing income tax returns back home in India.

Although NRIs are exempted from income tax on their overseas income, they have to file tax returns for their income earned in India e.g. interest earned on fixed deposit, rental income, any capital gain on the stock market or mutual funds, dividends, any royalty or fee for any services in India. See here to learn more about when does NRIs need to file income tax returns in India.

Many Indians in the UK, USA, Singapore, Australia, UAE, and Middle East, who regularly file income tax returns in India but do not have Aadhaar card, were worried to link Aadhaar with PAN (Permanent Account Number) issued by income tax authorities for tax and financial transactions After the Supreme Court judgement passed on 9 June 2017, if you have Aadhaar, it is mandatory to link it to PAN and mention the same in your tax returns.

In a notification issued by the government, the details of which are available on the official website of CBDT, the following sections of people are exempted from linking Aadhaar with PAN, but only if they don't have Aadhar card and don't wish to get Aadhar for filling income tax return in near future:

1) An individual who is residing in the state of Assam, Jammu and Kashmir, and Meghalaya.

2) An individual who is a non-resident Indian or NRI as per the Income Tax Act, 1961.

3) An individual of the age of eighty years or more at any time during the previous year.

4) An individual who is not a citizen of India.

But, if you have Aadhar card, then it's a good idea to link both Aadhar and PAN Card by following the steps shown above. It's simple and easy and you can do it in just 5 to 10 minutes.

Government's move is directed by the fact that many people hold multiple PAN Card, as of now, Aadhar is issued to 11 Crore people but there are more than 25 Crore people with PAN Card.

In short, It's not mandatory for NRIs to quote Aadhar card number for filing income tax returns in India. Though, it's a good idea to link Aadhar number to PAN number, if you have it already. If you don't have Aadhar yet, then make sure yo apply for Aadhar card when you visit India next time.

The procedure and documents required to apply for Aadhaar card for an NRI are similar to the process that an Indian resident has to go through. You will need to visit the official website of UIDAI or your local Aadhar enrolment centers to apply for the Aadhar Card online or offline

Other NRI Income tax articles you may like

Thanks for reading this article so far, if you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.

Many of my NRI friends and colleagues have been asking me this question from last a couple of weeks that I am an NRI and I don't have Aadhaar card, what should I do? Does Aadhar card be mandatory for filling income tax return on 2017?

Well, it's mandatory for resident Indians to link their Aadhaar card with PAN Card but NRIs or Indians, who are living abroad for more than six months (182 days to be exact) in the last 12 months, are not required to furnish Aadhar card detail in their income tax return, if they don't have Aadhaar yet.

In other words, NRIs are exempted from Aadhar card and PAN linking as well. But if you have an Aadhaar card, it’s a good idea to link it anyway now. You can link your Aadhar Card with PAN card online on the income tax website.

How to link your Aadhaar to PAN Online?

Here is a step by step guide to link your Aadhar card to PAN Card Online:Step 1:

Just go to www.incometaxindiaefiling.gov.in and click on the link on the left pane – Link Aadhaar

Step 2:

Provide PAN, Aadhaar no. and enter your name as given in Aadhar card (avoid spelling mistakes) and submit. After verification from UIDAI which is the government website for Aadhaar and maintains all your personal data, the linking will be confirmed.

In the case of any minor mismatch in the name provided in Aadhaar card, an Aadhaar OTP will be required. Please ensure that the date of birth and gender in PAN and Aadhaar are exactly same.

In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and the taxpayer will be prompted to change the name in either Aadhaar or in the PAN database.

Btw, The Indian government has exempted Non- Resident Indians (NRIs) from the requirement of quoting Aadhaar card number while filing income tax returns back home in India.

Although NRIs are exempted from income tax on their overseas income, they have to file tax returns for their income earned in India e.g. interest earned on fixed deposit, rental income, any capital gain on the stock market or mutual funds, dividends, any royalty or fee for any services in India. See here to learn more about when does NRIs need to file income tax returns in India.

Many Indians in the UK, USA, Singapore, Australia, UAE, and Middle East, who regularly file income tax returns in India but do not have Aadhaar card, were worried to link Aadhaar with PAN (Permanent Account Number) issued by income tax authorities for tax and financial transactions After the Supreme Court judgement passed on 9 June 2017, if you have Aadhaar, it is mandatory to link it to PAN and mention the same in your tax returns.

In a notification issued by the government, the details of which are available on the official website of CBDT, the following sections of people are exempted from linking Aadhaar with PAN, but only if they don't have Aadhar card and don't wish to get Aadhar for filling income tax return in near future:

1) An individual who is residing in the state of Assam, Jammu and Kashmir, and Meghalaya.

2) An individual who is a non-resident Indian or NRI as per the Income Tax Act, 1961.

3) An individual of the age of eighty years or more at any time during the previous year.

4) An individual who is not a citizen of India.

But, if you have Aadhar card, then it's a good idea to link both Aadhar and PAN Card by following the steps shown above. It's simple and easy and you can do it in just 5 to 10 minutes.

Government's move is directed by the fact that many people hold multiple PAN Card, as of now, Aadhar is issued to 11 Crore people but there are more than 25 Crore people with PAN Card.

In short, It's not mandatory for NRIs to quote Aadhar card number for filing income tax returns in India. Though, it's a good idea to link Aadhar number to PAN number, if you have it already. If you don't have Aadhar yet, then make sure yo apply for Aadhar card when you visit India next time.

The procedure and documents required to apply for Aadhaar card for an NRI are similar to the process that an Indian resident has to go through. You will need to visit the official website of UIDAI or your local Aadhar enrolment centers to apply for the Aadhar Card online or offline

Other NRI Income tax articles you may like

- 3 Income tax benefits of opening NRI accounts in India

- 13 ways to save income tax in India

- 10 Income tax deductions and exemptions NRIs should know

- How NRIs can file their income tax returns online

- Is NRIs overseas income taxable in India

- How much TDS is deducted on NRO account?

- Is it mandatory to file income tax returns for NRIs?

- Is it mandatory for NRIs to declare foreign bank accounts on tax returns?

- How to determine tax residential status of NRIs?

- 10 points NRIs should know about Income tax?

- Is Aadhaar card Mandatory for filing an Income tax return for NRIs?

Thanks for reading this article so far, if you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.

By the way, rules changes so its better to always verify the information from official sources like income tax websites or Aadhaar sites. If you think any information change on this article, you can also let me know in comments and I will update accordingly.