I come to know about this excellent pension scheme just now after listening respected Prime minister Narendra Modi Ji's independence day speech. Since many Indians works in private sector where there is no pension and India…

Read more

If you are going for holidays or work to Dubai, Singapore, or the USA from India and wondering how much Indian rupees you can carry to overseas then you need to know the Indian customs official limit about the export of Indian c…

Read more

In this article, I'll answered some of the frequently asked questions about Aadhaar card and PAN card and their linking for NRIs and Indians living abroad. Though, the most important thing to remember is that NRIs are not el…

Read more

One of the common doubt among NRI community is whether they are eligible for Aadhaar Card or not. The doubt has created more worry with the recent announcement of the Indian government that Aadhaar will be mandatory for filing i…

Read more

I was thinking is it right time to invest in Indian Stock Market? As no one can predict equity or time the market, for long term investor, every time is the right time. Looking at what happening at the moment in India, as it ju…

Read more

NRE Fixed deposits are one of the best options for NRIs. It's safe, offer fixed and good returns and most importantly interest earned on NRE fixed deposit are not taxable in India . On top of that, you can also repatri…

Read more

If your passport has been expired or about to expire and you are living outside India then you can submit your passport renewal application at Overseas itself. Indian High Commission and their affiliate agent accept passport ren…

Read more

When a Resident Indian becomes an NRI he needs to convert his Resident saving account to NRO account as per Indian banking and income tax laws e.g. FEMA. The NRO account provides the simplest way to access and operate the money …

Read more

Yes, NRI can invest in the stock market as well as in mutual funds in India, provided they have an NRE saving account in India. Investing in a Mutual fund is easier than directly investing in Stocks because you don't need a…

Read more

You can send money abroad on your overseas savings account from an NRE account in India. You can do this both online from the comfort of your office or home and offline from any branch of your bank. This is also known as repatr…

Read more

I recently come to know about ICICI bank's powerful service called express e-transfer which allows ICICI bank Money2India users to send money instantly to India from the USA and Canada to India. ICICI bank claims that they …

Read more

Apart from international wire transfers, western union, and MoneyGram, there are three major online services you can use to send money from Hong Kong to India. Apparently, Hong Kong has fewer options as compared to Singapore fo…

Read more

You can use Western Union's money transfer facility If you are sending money to your parents or relatives in India, who are not used to modern banking and don't have any internet banking or simply a bank account. The Wes…

Read more

Many of my NRI readers ask me frequently, should I open an NRI saving account in India? Is it must for an NRI to open NRE or NRO account? Can I continue my existing Saving account in India? etc. Well, If you are going abroad f…

Read more

The NRE account stands for the Non-Resident External account and I strongly believe, every NRI who has any interest in India must open this account. It has some excellent features which are not available to other types of accoun…

Read more

One of the most common doubt among new NRIs are about their bank accounts e.g. what happens to their bank account, Fixed deposit, Demat accounts like ICICI Direct, brokerage accounts, and insurance policies when they become non-…

Read more

If you know about NRI banking facilities and different accounts the y can open in India i.e. NRE , NRO , FCNR , and RFC then you know that there are different rules to deposit money on these accounts, but it's not clear to m…

Read more

Yes, you can open a joint NRE or NRO savings, current or fixed deposit and FCNR fixed deposit account , but who you can use as joining partner depends on upon what type of account you are opening and citizenship of other account…

Read more

Can NRI open more than one NRE, NRO or FCNR account with different banks? Yes, an NRI can more open more than one NRE, NRO or FCNR accounts with different banks in India. I am not exactly sure if you can open two acco…

Read more

If you are an NRI , which has both PAN card and Aadhaar card then it is must for you to link your PAN card with the Aadhaar card . Failing to do so, will result in their PAN card cancellation. Though I have not seen any official…

Read more

It's that time of the year again when every NRI starts to worry about their income tax filing in India. Thankfully, due to technological advancements, now NRIs can file income tax online with their comfort of office and hom…

Read more

It's that time of the year again when every India taxpayer (including those who lives abroad) start to worry about filling your income tax in India. Like previous year, 31st July is the last date to file your income tax ret…

Read more

Whether the global income of NRI is taxable or not depends on NRI's residential status in India for that financial year e.g. from 1st April to 31st March. If NRI's tax status is "resident" in the financial ye…

Read more

Hello guys, if you are wondering whether interested earned on NRO saving account or NRO fixed deposit is taxable in India or not then you are at the right place. Yes , unlike interest earned on both NRE saving account and NRE fi…

Read more

If you are sending money to India from any abroad location e.g. United States, Singapore, United Kingdom, or Australia, it's worth checking rates offered by different remitting services like DBS India Remit, CurrencyFair , H…

Read more

In this article, we will understand the difference between two of the best investment option of conservative investors, PPF or Public Provident Fund and Fixed Deposit, known as FD . Both PPF and FD provides the capital guarante…

Read more

Recently I was doing some research to open an NRI Savings account in India , and given there are so many banks, both public and private sector are providing NRI services, I thought to do some quick checks on the best NRI…

Read more

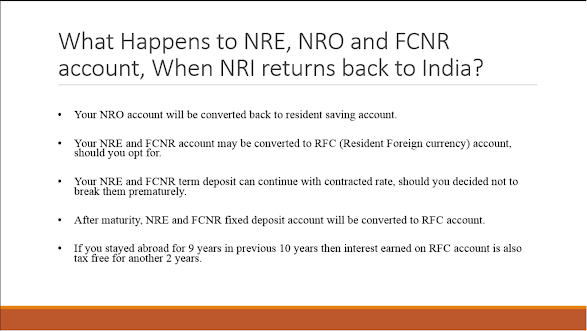

One of the most common doubt among Non Resident Indians related to NRI accounts are, what will happen to their NRE, FCNR, and NRO account when they return back to India? Even though you are not coming back in near future its go…

Read more

If you are an Indian, I am sure you must have heard about Public Provident Fund or PPF, one of the most popular long-term saving scheme backed by the government of India. If not about PPF, then definitely about EPF, Employee Pro…

Read more

This month, particularly this week, starting from 18th April was pretty bleak for Indian IT professional looking for migration and an onsite opportunity to Australia, NewZeland, and the USA. Things were not easy from quite some …

Read more

Mandate Holder is a unique facility many private sector banks like ICICI and HDFC bank provides to NRI customers. According to this faculty, NRE/NRO account holder can appoint a resident Indian (a family member only) to manage …

Read more

Should you Invest in FCNR fixed or term deposit? FCNR (Foreign Currency Non Resident) deposit is another way NRI can invest money in fixed deposit, this is the third option for Indians staying abroad along with more popular NRE…

Read more

Yes , you can add any family member or close relatives as a nominee in your NRE account . Almost all the banks, both public sector like SBI, Bank of Baroda and private sector banks e.g. ICICI, HDFC, Axis Bank provides …

Read more

NRE or NRO savings account, which should I open is first doubt comes in mind of any Non Resident Indian (NRI), who wants to open saving accounts in India on Indian banks like ICICI bank, SBI bank, HDFC Bank, Kotak Mahindra Bank …

Read more

NEFT and RTGS are two main ways of electronically transferring money between two banks in India using net banking accounts. Suppose you have a resident, NRI or NRO account from ICICI bank and want to transfer money to your fami…

Read more

Why Invest in NRE Fixed Deposit in India? NRE Fixed Deposit is very hot at this moment with soaring interest rate and very lucrative Exchange rates from USD to INR, SGD to INR and from other foreign currencies. For all those In…

Read more

Recurring deposit for NRI customers NRI recurring deposit is a new investment option offered by many Indian banks like HDFC Bank, SBI, ICICI and Kotak Mahindra, after their successful run with NRI fixed deposit . With almost 25…

Read more

NRIs are always in doubt with taxation and many times they end up by paying double tax on same income, both in the foreign country they are currently working and staying and on India. In order to avoid this double taxation of in…

Read more

An RFC (Resident Foreign Currency) Savings Account is a savings account maintained in foreign currencies e..g USD, CAD, EURO or GBP for NRIs who have returned to India for good but has some foreign currency fund to park. One of…

Read more

If you are an NRI, currently outside India and your passport's expiry is near then you might be thinking about re-issue of passport, but if you are confused between renewal and re-issue of an Indian passport then you have co…

Read more

Yes, NRIs can take personal loans in India, nothing stops them except the bank which are giving Personal loans. Unfortunately, even though, all the public sector banks e.g. SBI, Bank of Baroda, Punjab national bank, private sect…

Read more

In my last post, can NRI invest in National Pension Scheme , I told you that NRIs are now allowed to open NPS accounts , it's time to share more information about NPS like why an NRI should invest in National Pension Scheme.…

Read more

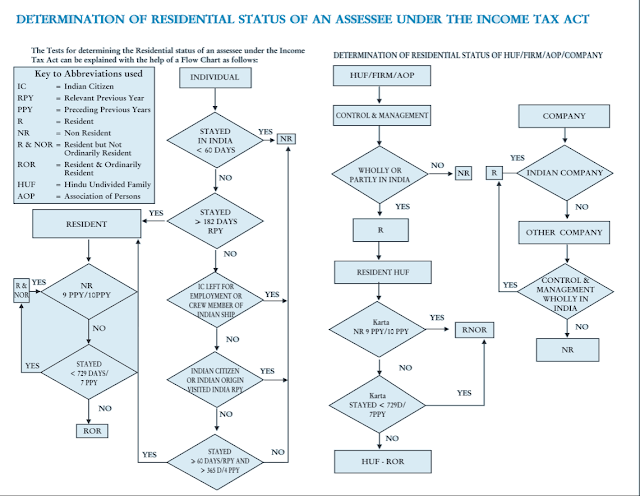

Let me answer the second question first to convince you why a returning NRI would like to find out whether he is a resident or a non-ordinarily reside (RNOR)? Well, there is big tax benefit of filing income tax return in India …

Read more

One of the important question among Indians going abroad or NRIs returning from overseas to India for a good is to check their residential status to see whether they qualify as an NRI, an RNOR or an Ordinary Indian Resident in …

Read more

One of the most frequently asked question among NRI community post the historic announcement of demonetization of Rs 500 and Rs 1000 notes in India is whether NRIs can send the Indian currency to India using FedEx, DTDC or DHL e…

Read more

One of the important detail many NRIs ignore while opening NRE or NRO saving account is the minimum account balance required to be maintained on the monthly or quarterly basis. Sometimes this is also known as average monthly b…

Read more

Nowadays, opening an NRE or NRO account from overseas has become quite easy with an online application form and free pickup services offered by many Indian public sectors and private sector banks. Almost all major banks includi…

Read more

In the last couple of articles, I have told you why health insurance is important for parents and what are the tax benefits you get by buying health insurance for your family and parents ( see here ), but I have not shared any …

Read more

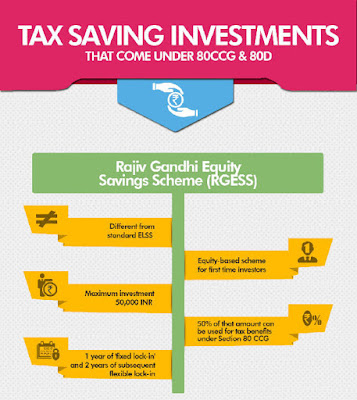

If you have been filing your income tax returns in India then you know that there are a lot of tax saving options you can use to claim tax deductions and exemptions under a various section of income tax law of India. For examp…

Read more

In last article, I told you that you can use the DTAA (Double Tax avoidance Agreement) to prevent double taxation of same income in two countries. Since most of the NRI pay their taxes in their country of employment or residen…

Read more

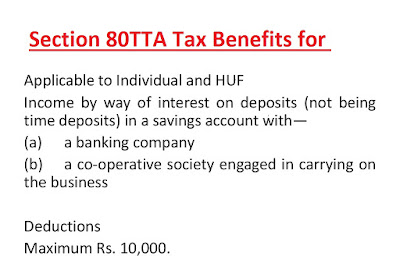

Do you know that Non-resident Indians can claim a deduction on income from interest on saving bank accounts up to a maximum of 10,000 INR like resident Indians? Well, I didn't. I just come to know about this relatively new t…

Read more

Recently one of my friend, working for an IT company in the USA on H1B visa received notification from Indian banks and Mutual funds that he needs to submit FATCA compliant certificates. He wasn't sure about what is FATCA …

Read more

Since the last date of the financial year 31st, March is approaching, many Mutual funds, brokerage house, and Insurance companies are aggressively promoting their products in a bid to attract income taxpayers who like to save ta…

Read more

Many Indians who goes to work abroad for work opens NRE saving and NRE fixed deposit account to take benefit of higher interest rate and absolutely no tax on interest earned on those account, but do you know what happens to your …

Read more

One of the most important and controversial points of the recently concluded Indian budget 2016 is the taxation on Employee Provident Fund withdrawals. Earlier, similar to PPF , EPF was also completely tax-free, i.e., whatever a…

Read more

The answer is both Yes and No , it depends on the source of funds. Technically, Yes, you can deposit INR or Indian rupees in NRE account in India with both private banks e.g. HDFC, ICICI, Kotak, YesBank, Federal Bank, and any p…

Read more

After India's great demonetization drive, NRIs are worried about taking cash overseas. I often received queries regarding this and one of the common ones is, how much Indian currency an NRI can take to India from Overseas? T…

Read more

In theory, there is absolutely no limit to how much money you can send to India, provided you earned your money legally and paid your taxes but the USA is special. In practice, depending upon which channel you are using for send…

Read more

The Indian Customs limits on the amount of cash anyone can carry from abroad to India is different for Indian currency (INR) and foreign currency e.g. US Dollars, Pound or Yen. The cash limit for traveling in India is also diffe…

Read more

When a young software engineer gets his first onsite opportunity, whether it's short-term or long-term, he is full of excitement. Nothing beats the excitement and adventure of going abroad, especially in America or Europe. A…

Read more

There are several ways to send money to India from Overseas, both online and offline. Some of the popular channel for remitting money includes the Western Union for the small amount of cash to online services like ICICI Money2In…

Read more

Do I need to Pay Taxes in India When I transfer money from an Overseas bank to India? Many of my IT friends are working abroad and when you go abroad the first time, you have a lot of queries in your mind, related to NRI status…

Read more

Remit2India, one of the popular remittance services among NRIs has recently launched an instant money transfer service from Australia to India. This means now you can remit money instantly, earlier it used to take 2 days. Along …

Read more

This is one of the frequently asked questions from NRIs, main from those who have not yet opened any saving account in India. NRIs (Non-Resident Indians) can open different types of bank accounts in India e.g. NRE (Non Resident…

Read more

TL;DR: You can now invest more than 1 lakh rupees on your PPF account , thanks to the increased limit in the 2014 budget . Earlier this limit was only 1 lakh but now it is raised to 1.5 lakh and so without doing any extra trick…

Read more

Non Resident Indians, who want to invest money in India, must first open a savings bank account. This will not only help you to easily remit money to India but also to transfer Indian rupees to your friends, relatives, and paren…

Read more

If you had just gone last year, how do you check whether you are an NRI or not? Well, this guide will help you to determine your NRI status. In general, if a person stays more than 182 days outside of India in a given financial…

Read more

![How to Send Money Abroad/Overseas from NRE or Resident Bank Account - [Online Outward Repatriation]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjzoGjHqy8LkY8kA5iiRF5_6qkjmVqqSod0_8lTSDuyP_zGK4RUrqYyLGiWIX_WeD2GqkfRUoOJC7t4eEeU-3kShtfRwYCDBAIyexriVb7ZyqIRltfTmM4cmrqBYjDtA4KUHjX4gWSB4VU/s1600/OUTWARD+Remittance+Limit+for+Indians.jpg)

![Does NRIs need to link their PAN Card with Aadhaar Card? How to Link Aadhaar with PAN Online? [Steps]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjwRTueCDlPmVgR4vELsMVY-lFPHCibr2KkX0QX7gP4Sq8KyK64B4FLo__WS2feFAoD-rfE0qdBUbXWofVu4ybE99fsJbheLGL52VSRdH6d4yFYusU-VSprzk-cMEgi-rYoqft8Gh8Uldc/w622-h288/Step_1_to_link_aadhar_to_pan_card_NRI.jpg)

![Can NRI deposit INR in NRE Account in India? [Answered]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiyNMH-k4-PVlOfd65Ggfeo8WHACFakP4r4Qx8b4ANEgydO3imZIsY1_TNB7CVgqeXG5Nj9nPXSb_0KbJi3vMx92FGEQIHIqsV2H_z7RiLWaoSKByUWYzpbKfmG00M7YLf-7DKLhlaqZYQ/w629-h354/Can+NRI+deposit+INR+on+NRE+account.png)