TDS stands for Tax deducted at source, is income tax levied on interest earned by Fixed deposits. The rate on which TDS is applied varies, depending upon, whether the Fixed deposit is with a bank, a company or the post office.…

Read more

Yes, Under the exchange control law, NRIs are allowed to buy property in India except for agricultural land, farm house or any plantation property. This means NRIs can buy flats, bungalows, residential plots, and landed propert…

Read more

Yes, NRO account is taxable in India . Both interests earned on NRO saving account and NRO fixed deposit are taxable under income tax law of India at the rate of 30% plus applicable cess and surcharge, which comes around 30.9…

Read more

One positive side-effect of Digitalization of financial services and Bank is increasing cashless transaction, be it by using Debit card, Credit, Card, Mobile Wallets e.g. Paytm, or cheques. If you look at all of them Cheque is p…

Read more

If you are eligible to open Sukanya Samriddhi Yojna account , as per eligibility criterion showed here and decided to open a sukanya samriddhi account then, accept my congratulations. It's a great decision to secure future …

Read more

You can open Sukanya Samriddhi account with both post office and banks. Initially when the scheme was launched it was only available to Post office but Reserve bank of India has instructed a list of authorized banks to open SSY …

Read more

Recently many of my colleagues received an email from their banks e.g. ICICI and HDFC bank regarding their saving accounts to update Aadhaar on their bank accounts, the deadline to link Aadhaar with a bank account is 31st Decemb…

Read more

How to find EPF (Employee Provident Fund) account balance online You can now check your EFF (Employee Provident Fund) account balance online from the comfort of your office and home. No need to endure stress on multiple runs…

Read more

Ever since Sukanya Samriddhi Yojna account has launched parents are very enthusiastic to open SSY account in the name of their daughter. Many of my friends have asked about whether they can open Sukanya Samriddhi account or not…

Read more

Many people ask me whether they should invest money in stocks or mutual fund or not? I say, you should invest at least some part of your money into equities because it is the only investment which can beat inflation in the long …

Read more

There is a wise saying that "one penny saved is one penny earned" . This is true even in the world of investment and saving. In today's volatile world your gain on equities or other investment options e.g. bond or …

Read more

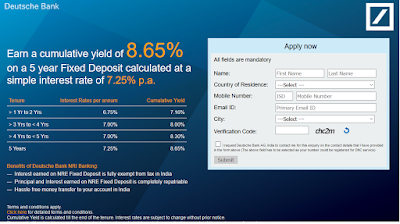

Recently one of my readers asked me that he wants to invest some money on NRE fixed deposits but confused on whether to go for foreign banks like Citibank, DBS, Standard Chartered, Deutsche Bank or Indian banks like ICICI, Kota…

Read more

One of the common questions amount NRI investor putting their money on NRE fixed deposit is whether they can close the NRE fixed deposit before maturity or not? and if breaking the NRE FD is allowed then what is the penalty? Thi…

Read more

In short, No, interest earned on NRE fixed deposit is tax-free in India . If you are an India working abroad and earning in foreign currency, you have a couple of more investment options available than to a resident customer. If…

Read more

If you are an Indian staying in Singapore and want to open NRE or NRO account with Indian banks like SBI, Kotak, HDFC, ICICI, Yes Bank, Axis Bank, or a foreign bank with Indian operations like DBS bank, then you have a couple of…

Read more

As the name suggests, Resident Fixed deposits are for Residents of India and NRI fixed deposits are for Non-resident Indians but remember both are for Indian Citizens. Indian banks, both private banks e.g. ICICI, HDFC, Kot…

Read more

Well, I am not an analyst, who can say that whether it's right time to invest in gold or not, but since I am a common man like many others, which follows some simple rules while investing money and follows principle of diver…

Read more

With Rupee falling every day and touching a new all-time low of almost $1 to Rs 83, many of NRI Indians are asking this question, is it a right time to transfer money to India or is it the right time to invest in FCNR deposits …

Read more

PM Modi has launched several good financial schemes e.g. Atal Pension Yojna to provide retirement solutions to many peoples from un-organized sector, PradhanMantri Jan Dhan yojana to open bank accounts for poor, Pradhan Mantri …

Read more

One of the most common doubts among every new NRIs mind is whether they need to file income tax returns in India or not. As I told earlier that it's not mandatory to file an income tax return in India , but now questions co…

Read more

Many NRIs buy property in India by taking NRI home loans, but when it comes to tax saving, most of them are not sure whether they are eligible for any tax saving in India or not. They just earned in abroad and replay the home lo…

Read more

One of the bad thing about Fixed deposits are TDS, i.e., tax deducted at source. If you don't pay attention to TDS or doesn't do enough to prevent or avoid TDS, you could lose the right amount of your interest income to …

Read more

NRIs (Non Resident Indian) are allowed to open bank accounts in India, and by knowing features and the tax benefit of different types of NRI accounts, you can save the right amount of money. There are three types of accounts an…

Read more

Many NRIs are not aware of income tax laws in India and doesn't know whether they have to file income tax returns in India or not. Sometimes they also wonder, do they have to include income earned in the USA as well or only …

Read more

Yes, both NRIs and Resident can remit the money obtained by selling properties in India, but you have to take a couple of things in your mind. For example, the sale proceeds amount must be deposited into NRO account , it cannot …

Read more

One of the common doubt among NRIs who are filing their income tax returns in India is to whether to declare foreign bank accounts and assets or not . I often receive comments and questions whether it's mandatory for an NRI …

Read more

Does it necessary for NRI to File Income Tax Return in India? One of the most common doubt every NRI has is whether its mandatory for them to file incomes tax return in India or not? Short answer is, it depends . If you are a…

Read more

Due to high interest rate offered by Indian banks for NRI customer there is a lot of interest on FCNR and NRE Fixed deposits and I am receiving query like can I break my FCNR deposit before maturity almost everyday now. It depend…

Read more

Even though both Wire transfer and ACH are ways to send a large amount of money from one place to another, there are some significant differences in the way they operate. A wire transfer, also commonly referred to as SWIFT trans…

Read more

If you are an NRI and have income in India like rental income and your annual income is more than 2.5 lakh, the basic exemption limit then you can reduce your taxable income by investing in an NRO tax saver fixed deposit . NRO t…

Read more

Hello guys, if you are looking for a long-term, tax-saving option to put your hard-earned income then you have come to the right place. While there are a lot of tax-saving options available to NRIs and Indians in India the…

Read more

![Which Documents Required for opening Sukanya Samriddhi Yojna Account In India? [List]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgEtTTCjRbcXlKnG6_OszWNxvdqkY3IqUoS126PDtvJmjGACTfMTjxPbhVadEbv4TyJRj6StfvSJl_3p7oTzw-J5nj3ZPNfC1ZATwiNRR41EJhX-ZQuSM2PS9tmayCKodcVkU4Y-ran6zk/w557-h731/Sukanya+Samriddhi+Account+Form+PDF.png)

![Can You break FCNR Fixed Deposit before Maturity? [Answered]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgFPB1al9aViEuOZUvJ4VMmAEs6umzNXqsDHo5jxhw8CgY07-neq0PXUjvd7qX_CdZKnNQCYM4JsrchK_wTcwh-MqhjOPm4ZOOtirOxDnprQeS__EQiwBc-E61vn23rs4QDcwU7aJiNq6E/s1600/FCNR+fixed+deposit+premature+withdrawl+penalty.jpg)