Recently one of my readers asked me that he wants to invest some money on NRE fixed deposits but confused on whether to go for foreign banks like Citibank, DBS, Standard Chartered, Deutsche Bank or Indian banks like ICICI, Kotak, HDFC, SBI, Axis Bank or Union Bank? I asked him, whether he has any existing NRE saving account, he says he doesn't have any existing NRE saving account? Then I ask him what is more important for you? the interest rate or convenience? and his answer was the interest rate.

So, if you are on the same boat than its perfectly easy, because there are lots of websites on the Internet which offers a nice comparison of NRE fixed deposit rates for both Indian and foreign bank, both public and private sectors e.g. moneycontrol.com.

Even though, interest rate is more important for many NRI investors, security and convenience cannot be ignored, for example, its not great to open an NRI fixed deposit with any co-operative bank or lesser known private sector bank, just because they are offering better interest rates, couple of basis point doesn't matter much unless your opening fixed deposits in corners as much as convenience and safety.

As I said, depending upon your criteria and priority among interest rate, safety, and convenience you can easily compare rates offered by various foreign and Indian banks and choose one of them. On foreign banks, I like more respected names like Standard Chartered Bank and Deutsche Bank because they are offering very good interest rate at the moment and they are quite safe as well.

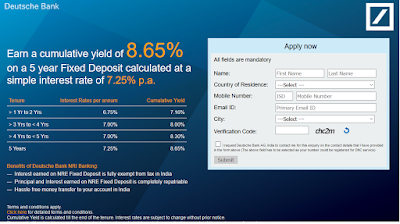

For example, Standard Chartered Bank is offering 8.30% interest rate per annum for NRE fixed deposit of 376 days to 390 days and you can earn 7.25% p.an for 5 years with Deutsche Bank Fixed deposit, this is a really good deal because since interest earned on NRE fixed deposit is tax free, your overall yield would be around 8.65%, that's a very good safe, guaranteed return.

The Abu Dhabi Commercial bank is also offering very good 8.5% p.a. the interest rate for 1 to 2 years NRE FD.

More established names like Citibank and HSBC even though they are good at safety and convenience point of view, they offer very poor interest rates e.g. around 6.75 to 7% p.a. for 1 to 2 years.

Another added advantage of choosing foreign bank is that you can directly transfer money using their remittance service or swift e.g. DBS India remit is the best way to send money from Singapore to India.

Indian bank on other hands also offer competitive rates, I prefer to choose private sector banks like HDFC, Kotak, YES Bank, ICICI, and Axis bank because of their better customer service.

Even though they are not as safe as SBI or other bigger public sector banks like Union Bank or Bank of Baroda. Currently, Kotak bank is offering best NRE fixed deposit rates of 8.75% for 1 to 2 years period. The DCB bank is next at around 8.10 and then Axis bank and YES BANK are somewhere around 7.10% p.a.

But, if you already have an NRE saving account be with HDFC, ICICI or SBI, you should use that one for opening NRE FD, it's much more convenient as you don't need to manage multiple NRE accounts and don't need to submit KYC documents to multiple banks every 2 years.

In short, you can choose between foreign and Indian banks based on interest rates, safety, and convenience. On Indian banks, you also have a choice between the public sector and the private sector.

Since you are investing your hard-earned money, I suggest you don't look at 0.5 or 1% higher basis point and stick with bigger and safer banks like HDFC, ICICI, and SBI. But for a small amount you can also take repeated foreign banks like Standard Chartered and Deutsche Bank.

Choosing a bank like Citibank is not a great idea because it offers really poor rates, the same is true for DBS banks, which has launched its services last year.

Sometimes, public sector banks like UNION bank also offer more competitive interest rates on NRE fixed deposits, so don't forget to compare rates before opening NRE or NRO fixed deposits.

So, if you are on the same boat than its perfectly easy, because there are lots of websites on the Internet which offers a nice comparison of NRE fixed deposit rates for both Indian and foreign bank, both public and private sectors e.g. moneycontrol.com.

Even though, interest rate is more important for many NRI investors, security and convenience cannot be ignored, for example, its not great to open an NRI fixed deposit with any co-operative bank or lesser known private sector bank, just because they are offering better interest rates, couple of basis point doesn't matter much unless your opening fixed deposits in corners as much as convenience and safety.

Foreign or Indian Bank, which one is better to open NRE FD

As I said, depending upon your criteria and priority among interest rate, safety, and convenience you can easily compare rates offered by various foreign and Indian banks and choose one of them. On foreign banks, I like more respected names like Standard Chartered Bank and Deutsche Bank because they are offering very good interest rate at the moment and they are quite safe as well.For example, Standard Chartered Bank is offering 8.30% interest rate per annum for NRE fixed deposit of 376 days to 390 days and you can earn 7.25% p.an for 5 years with Deutsche Bank Fixed deposit, this is a really good deal because since interest earned on NRE fixed deposit is tax free, your overall yield would be around 8.65%, that's a very good safe, guaranteed return.

The Abu Dhabi Commercial bank is also offering very good 8.5% p.a. the interest rate for 1 to 2 years NRE FD.

More established names like Citibank and HSBC even though they are good at safety and convenience point of view, they offer very poor interest rates e.g. around 6.75 to 7% p.a. for 1 to 2 years.

Another added advantage of choosing foreign bank is that you can directly transfer money using their remittance service or swift e.g. DBS India remit is the best way to send money from Singapore to India.

Indian bank on other hands also offer competitive rates, I prefer to choose private sector banks like HDFC, Kotak, YES Bank, ICICI, and Axis bank because of their better customer service.

Even though they are not as safe as SBI or other bigger public sector banks like Union Bank or Bank of Baroda. Currently, Kotak bank is offering best NRE fixed deposit rates of 8.75% for 1 to 2 years period. The DCB bank is next at around 8.10 and then Axis bank and YES BANK are somewhere around 7.10% p.a.

But, if you already have an NRE saving account be with HDFC, ICICI or SBI, you should use that one for opening NRE FD, it's much more convenient as you don't need to manage multiple NRE accounts and don't need to submit KYC documents to multiple banks every 2 years.

In short, you can choose between foreign and Indian banks based on interest rates, safety, and convenience. On Indian banks, you also have a choice between the public sector and the private sector.

Since you are investing your hard-earned money, I suggest you don't look at 0.5 or 1% higher basis point and stick with bigger and safer banks like HDFC, ICICI, and SBI. But for a small amount you can also take repeated foreign banks like Standard Chartered and Deutsche Bank.

Choosing a bank like Citibank is not a great idea because it offers really poor rates, the same is true for DBS banks, which has launched its services last year.

Sometimes, public sector banks like UNION bank also offer more competitive interest rates on NRE fixed deposits, so don't forget to compare rates before opening NRE or NRO fixed deposits.

Other NRE Fixed Deposit articles you may like

- Does Interest on NRE Fixed Deposit is Taxable?

- 10 Benefits of opening NRI Fixed Deposits in India?

- Can you Break NRE Fixed Deposit prematurely?

- Can you Open a Joint NRE or NRO Account with family?

- Can you add a nominee to your NRE or NRO Account?

- Difference between Resident and NRE fixed deposit

- How to open an NRE account in Singapore?

- Difference between NRE and NRO Fixed Deposit in India?

- Which banks offer higher interest on NRE Fixed Deposits

- Difference between Fixed and Recurring Deposit

Thanks for reading this article so far. If you find this information useful please share it with your friends and colleagues on Social media. You can also use the share button to share the articles on Twitter and Facebook.