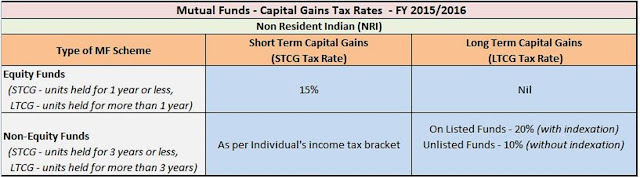

If you are an NRI and investing in Mutual funds in India, here are a couple of things you should know. 1) NRIs are allowed to invest in mutual funds in India on a repatriable or non-repatriable basis. Based on which…

Read more

Even though Health insurance is not a new concept for the world, I must admit that it's a relatively new thing in India and many people including those who are living in cities and earning well are not aware of the benefits …

Read more

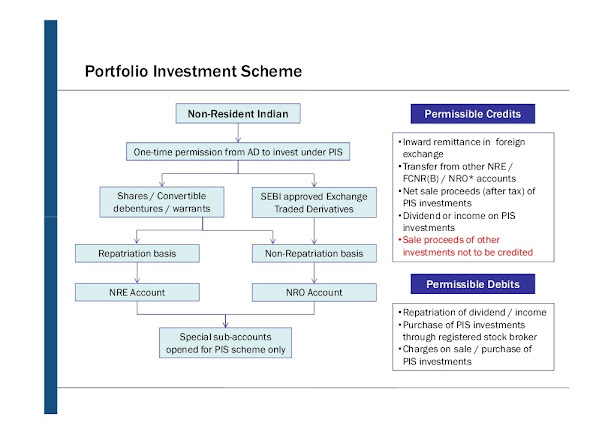

Hello guys, if you are interested in buying shares or doing trading on Indian stock exchanges like Bombay Stock Exchange BSE and National Stock Exchange NSE then you may hear about Portfolio Investment Scheme. RBI has allowed NRI…

Read more

There is no doubt that in today's expensive world you need a good health insurance policy for your family and parents. Hospitalization and Medical cost have risen significantly in India and expenditure ranging from 5 l…

Read more

Many of my readers ask me this question, can you apply for the Aadhaar card online? Can you apply for Aadhaar card outside of India, or do NRIs are even eligible for Aadhaar card or not. One of the key things to remember that NR…

Read more

Many of us are wondering how to generate money on Upwork as the gig economy and freelance work become more prominent. Upwork is one of the most prominent freelancing platforms in the world, and when a company wants to outs…

Read more

The harmonica is a small musical instrument that is played using the mouth with the aid of the wind. Sometimes it is called a French harp or mouth organ and is used in many music genres all around the globe; for instance, in…

Read more

Hello guys, if you want to break into Tech in 2025 but not sure how to do that then you have come to the right place. Earlier, I have shared many online courses and certification to learn Python , Coding , Data Science , Web Deve…

Read more

As the internet is a technology that never stays constant and has evolved over years, which has given us a variety of content and information to work, watch and play with. As well as the ability to develop infinite connections…

Read more

Hello guys, if you want to learn English in 2025 or want to improve your English skills and looking for best resources like books, tutorials, guides, and online courses then you have come to the right place. Earlier, I have share…

Read more

Hello guys, if you want to learn Blockchain in 2025 and want to become a Blockchain developer or architect and looking for best online courses to learn Blockchain in depth then you have come to the right place. Earlier, I have sh…

Read more

.png)