No, you cannot deposit Indian rupees into an NRE account . Th e only way to fund an NRE account is via foreign currency remittance , foreign currency deposit when you visit India, or via foreign currency traveler's cheque. S…

Read more

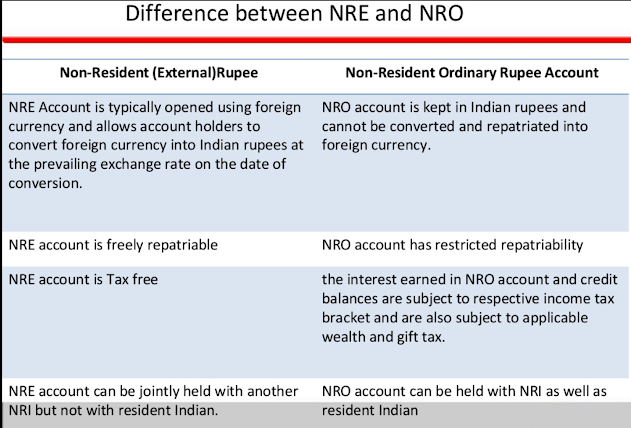

Yes, you can repatriate funds from NRE, NRO, or FCNR account abroad, but each has its own rules and limitations. For example, both NRE and FCNR accounts are most flexible in terms of repatriation, also known as freely repatriab…

Read more

One of the most common question among NRIs (Non-resident Indians), especially among IT professionals traveling to the USA, UK, Singapore onsite is whether they can transfer funds from one NRE account to another NRE account , or …

Read more

If you are working for an investment bank like Barclays, UBS, Goldman Sachs, or Citibank or a service company like Infosys or TCS and thinking to move to the USA on L1 VISA then but don't know the d ifference between L1A and…

Read more

In the last article, I told you how much Indian currency NRIs are allowed to take Overseas , and in this article, I'll talk about how much foreign currency NRIs are allowed to bring India and then take back while going Overs…

Read more