Yes, you can repatriate funds from NRE, NRO, or FCNR account abroad, but each has its own rules and limitations. For example, both NRE and FCNR accounts are most flexible in terms of repatriation, also known as freely repatriable, which means that no prior RBI approval is required to remit funds overseas from these accounts. This includes both NRE and FCNR fixed deposits as well as NRE saving the account. You can also repatriate both principal and interest earned overseas from these two accounts. One reason of that is because both of these accounts can only be opened form the fund you have earned overseas and you can only deposit the funds whose source is overseas. For example, you cannot deposit Indian rupees earned on India from rental income or any other income to NRE account.

On another hand, NRO accounts (savings, current and fixed deposit) is more restricted, they are not freely repatriable, which means you need to take prior approval from RBI to remit fund overseas.

On another hand, NRO accounts (savings, current and fixed deposit) is more restricted, they are not freely repatriable, which means you need to take prior approval from RBI to remit fund overseas.

The interest earned on your NRO Savings Account is repatriable after payment of taxes applicable in India and you can also transfer funds up to USD 1 Million in a year after taking RBI's permission, provided your funds are acquired out of rupee resources in India or by way of legacy or inheritance from a person who was resident in India.

What is Repatriation? What is freely Repatriable?

Repatriation of funds means remitting funds or sending money outside India. You may need to send money overseas for education purposes or for expenditures if your children are living and studying abroad.Usually, prior approval from RBI is required to remit money overseas, but there is something called freely repatriable, which means that no prior RBI approval required for remitting funds overseas.

NRE and FCNR accounts, both savings and fixed deposit are freely repatriable and thus very convenient to remit money and that's why one of the most popular accounts among NRI.

NRE and FCNR accounts, both savings and fixed deposit are freely repatriable and thus very convenient to remit money and that's why one of the most popular accounts among NRI.

You may also repatriate up to a maximum of USD 1 million (equivalent) per calendar year from your NRO account if the assets acquired are out of rupee resources in India or by way of legacy or inheritance from a person who was resident in India.

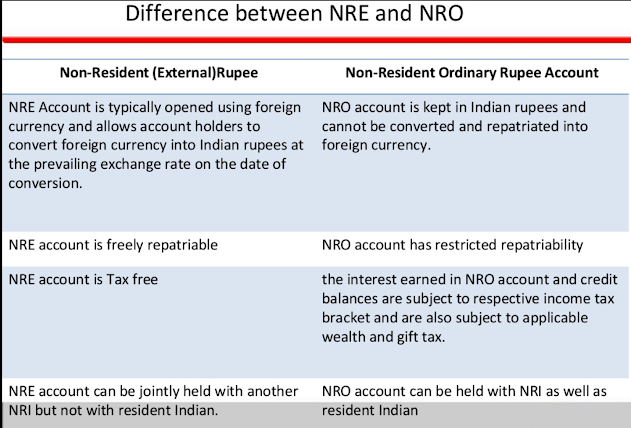

This is one of the important reason why you should open an NRE saving account, to learn more about the differences between NRE and NRO saving accounts, see here:

So, Yes you can send funds from NRE, NRO, or FCNR account overseas. Since NRE and FCNR are freely repatriable accounts, you can remit funds abroad without prior approval from RBI, you can also remit both interest and principal amount.

This is one of the important reason why you should open an NRE saving account, to learn more about the differences between NRE and NRO saving accounts, see here:

So, Yes you can send funds from NRE, NRO, or FCNR account overseas. Since NRE and FCNR are freely repatriable accounts, you can remit funds abroad without prior approval from RBI, you can also remit both interest and principal amount.

On the other hand, the NRO account is a little bit restricted. You can transfer USD 1M in a year, but you need to take prior approval from RBI.

You can also transfer interest earned on an NRO account but only after paying tax in India.

Other articles, you may like to explore:

Other articles, you may like to explore:

- How to open an NRE/NRO account from Singapore? (see)

- Sending Money to India? Always compare SGD to INR rates between DBS India Remit, MoneyToIndia, Remit2India, etc (see)

- How to open NRE/NRO saving account online from Overseas? (article)

- How NRIs can use DTAA to avoid double taxation? (article)

- The best way to transfer money from Singapore to India? (read)

- Can you transfer funds from NRE to the FCNR account? (answer)

If you have any questions or doubt feel free to ask in comments. I would be happy to answer if I know.

Greetings!

ReplyDeleteCan I transfer funds from IOB NRE account to my ICICI NRE account? and would there be any tax on me?

Yes, you can transfer, no tax best of my knowledge as both account is owned by you and it's not income just fund transfer

Delete