Spring Framework and Spring Boot are both Java-based development frameworks for building web applications, but there are some key differences between them which we will see in this article. We will also learn about important feat…

Read more

Can we withdraw money from the PPF account before maturity? One of the most common questions people ask before opening a PPF account is "can we withdraw money from a PPF account before maturity?" . One reason for this…

Read more

If you are an NRI (Non-Resident Indian) then you have access to a unique bank account called NRE (Non-Resident External) account which allows you to keep your money in Indian rupees. This account then further allows you one of …

Read more

ELSS (Equity Linked Saving Scheme), PPF (Public Provident Fund), NSC (National Saving Certificate), and Tax-saving fixed deposits with banks are four of the most popular way to save tax under section 80C , but which one is the …

Read more

NRIs are allowed to buy and sell properties in India, and they can also bring the profit post-sale of their property abroad, but there are a couple of things which you need to learn and remember. For example, you need to know t…

Read more

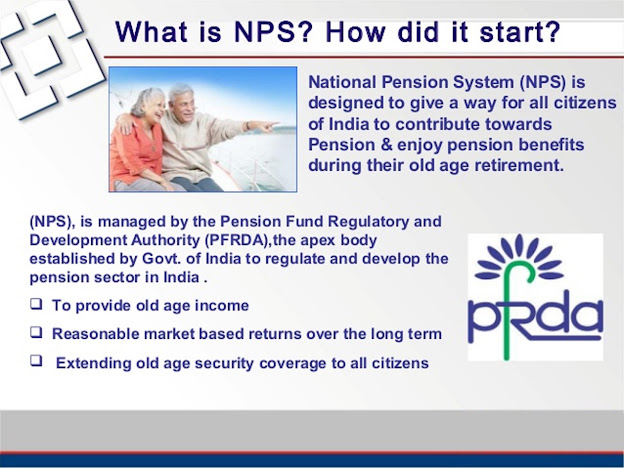

Yes, NRI can now invest in NPS or National Pension Scheme in India . Recently, on July 2015, PFRDA, the Pension Regulator has clarified that Non Resident Indians (NRIs) can invest in National Pension Scheme (NPS) to save for the…

Read more

This is one of the most frequently asked questions among Singapore NRI community. I often receive queries from IT professionals working in the city-state who have home loans back in India and thinking to pay off in full or a por…

Read more

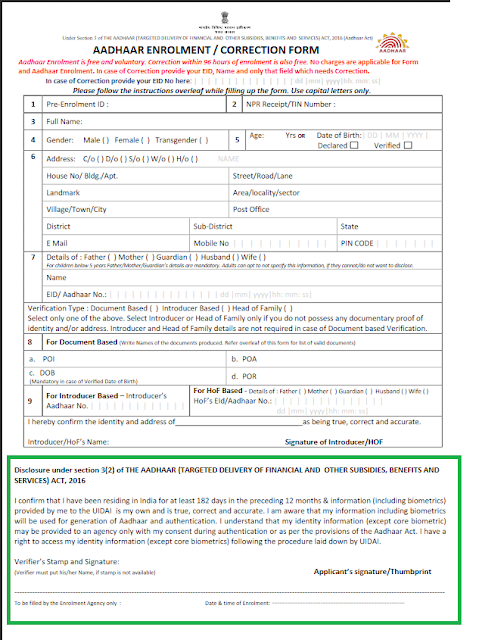

Ever since the income tax department of India made it mandatory to linked PAN card to Aadhaar card and ask every taxpayer to quote Aadhaar card number into the income tax return, many NRIs become worried. The reason was simple, …

Read more

I was searching for good health insurance plans for my family recently when I come to know about these "family floater health insurance plans". I have not heard this term before, so I did a bit of research about family…

Read more

As an India citizen, it's important for an NRI to know it's rights and responsibilities, especially about finance, tax, banking, and investments. When I first moved abroad I have absolutely zero knowledge of any of these…

Read more

People often mistook Public Provident Fund or PPF for Employee Provident Fund or EPF, though both are provident fund and backed by the government of India, they are independent of each other. The main difference between PPF and …

Read more

If you are living and working in Singapore or Hong Kong and thinking to open FCNR (Foreign currency Non-resident) fixed deposits in Singapore and Hong Kong dollar i.e. SGD or HKD then, unfortunately, you don't have many choi…

Read more

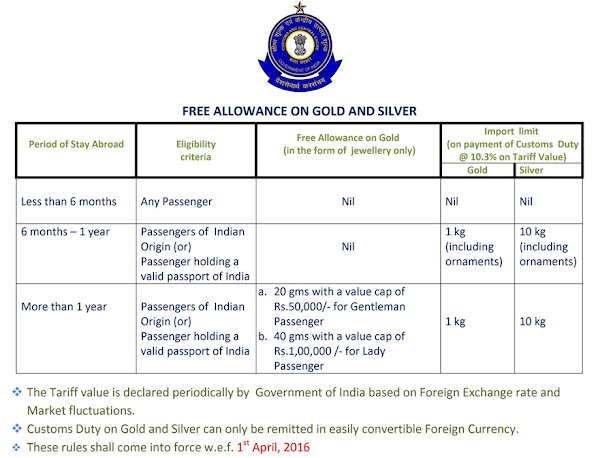

India is getting prosperous and foreign trip are not a privilege only rich people had in the past. Nowadays, many middle and upper-middle-class Indians are traveling abroad for holidays, vacations, honeymoons, study and just f…

Read more

Retirement Planning is very important in the age of nuclear families and western culture. There was time when Indians never bothered about Retirement Planning or Insurance because they trust that their children particularly Son …

Read more

Hello guys, FCNR term deposit is very hot at the moment. As I said in my last post it Right time to invest in FCNR deposit , it's the perfect time to get much better interest rates on foreign currency in India than abroad. If…

Read more

It's this time of the year when most of the salaried Indian think for tax saving investments. Most of the income taxpayers know about section 80C and the 1.5 lakh tax deductions it allows into your taxable income, but do you…

Read more

Good News for all income taxpayers of India, including NRIs and PIOs who pay income tax in India. Now, they can reduce additional 50 Thousand INR on taxable income by investing in the National Pension System (NPS) for the finan…

Read more

Online PPF Account with SBI and ICICI bank India Now you can open PPF or Public Provident Fund account online in India with ICICI bank and State Bank of India (SBI). This is a major step to increase popularity of PPF or Public …

Read more

Many people so much effort to earn money, but they don't put even 10% of that to save money from taxes and expenditure. In my post 10 ways to save money , I have talked about some general saving tips, now here you will learn…

Read more

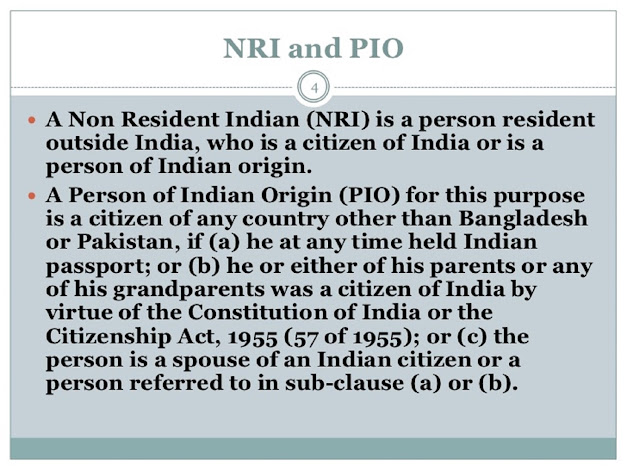

Though both NRI and POI are used to refers Indians living and working abroad and they have more or less similar rights to open a bank account , buy properties in India and restrictions e.g. not allowed to buy agriculture lands,…

Read more

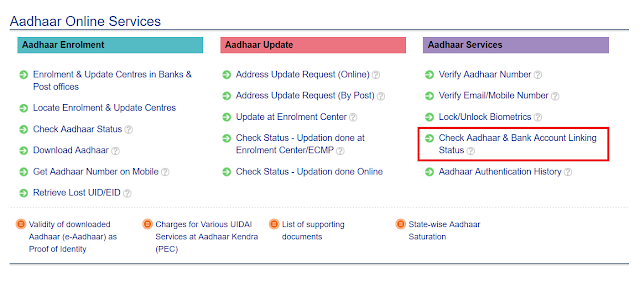

Hello Guys, welcome to the last post of 2017 in NRISavingsFunda and what could be the better topic than "linking Aadhaar" to close out the year. In this article, I'll show you how to check the status of your Aadhaa…

Read more

If you know, NRIs are allowed to invest in Stock Market in India i.e. they can purchase and sell shares in Stock Exchanges (Secondary Market) as well as they can buy stocks on Initial Public Offering (IPO), the Primary Market. …

Read more

If you hold an insurance policy in India, get ready to link it with Aadhaar. After bank accounts , PAN card , and mobile phones, it's time for insurance policies to be updated with Aadhaar number. Many NRIs have bought Life …

Read more

The Government of India has announced a new scheme called Atal Pension Yojana (APY). The APY is a guaranteed pension scheme and is administered by the Pension Fund Regulatory and Development Authority (PFRDA), which also admini…

Read more

TDS stands for Tax deducted at source, is income tax levied on interest earned by Fixed deposits. The rate on which TDS is applied varies, depending upon, whether the Fixed deposit is with a bank, a company or the post office.…

Read more

Yes, Under the exchange control law, NRIs are allowed to buy property in India except for agricultural land, farm house or any plantation property. This means NRIs can buy flats, bungalows, residential plots, and landed propert…

Read more

Yes, NRO account is taxable in India . Both interests earned on NRO saving account and NRO fixed deposit are taxable under income tax law of India at the rate of 30% plus applicable cess and surcharge, which comes around 30.9…

Read more

One positive side-effect of Digitalization of financial services and Bank is increasing cashless transaction, be it by using Debit card, Credit, Card, Mobile Wallets e.g. Paytm, or cheques. If you look at all of them Cheque is p…

Read more

If you are eligible to open Sukanya Samriddhi Yojna account , as per eligibility criterion showed here and decided to open a sukanya samriddhi account then, accept my congratulations. It's a great decision to secure future …

Read more

You can open Sukanya Samriddhi account with both post office and banks. Initially when the scheme was launched it was only available to Post office but Reserve bank of India has instructed a list of authorized banks to open SSY …

Read more

Recently many of my colleagues received an email from their banks e.g. ICICI and HDFC bank regarding their saving accounts to update Aadhaar on their bank accounts, the deadline to link Aadhaar with a bank account is 31st Decemb…

Read more

How to find EPF (Employee Provident Fund) account balance online You can now check your EFF (Employee Provident Fund) account balance online from the comfort of your office and home. No need to endure stress on multiple runs…

Read more

Ever since Sukanya Samriddhi Yojna account has launched parents are very enthusiastic to open SSY account in the name of their daughter. Many of my friends have asked about whether they can open Sukanya Samriddhi account or not…

Read more

Many people ask me whether they should invest money in stocks or mutual fund or not? I say, you should invest at least some part of your money into equities because it is the only investment which can beat inflation in the long …

Read more

There is a wise saying that "one penny saved is one penny earned" . This is true even in the world of investment and saving. In today's volatile world your gain on equities or other investment options e.g. bond or …

Read more

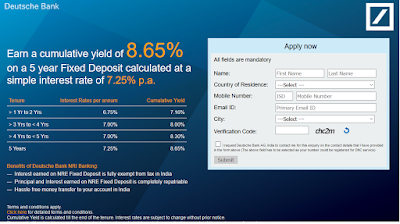

Recently one of my readers asked me that he wants to invest some money on NRE fixed deposits but confused on whether to go for foreign banks like Citibank, DBS, Standard Chartered, Deutsche Bank or Indian banks like ICICI, Kota…

Read more

One of the common questions amount NRI investor putting their money on NRE fixed deposit is whether they can close the NRE fixed deposit before maturity or not? and if breaking the NRE FD is allowed then what is the penalty? Thi…

Read more

In short, No, interest earned on NRE fixed deposit is tax-free in India . If you are an India working abroad and earning in foreign currency, you have a couple of more investment options available than to a resident customer. If…

Read more

If you are an Indian staying in Singapore and want to open NRE or NRO account with Indian banks like SBI, Kotak, HDFC, ICICI, Yes Bank, Axis Bank, or a foreign bank with Indian operations like DBS bank, then you have a couple of…

Read more

As the name suggests, Resident Fixed deposits are for Residents of India and NRI fixed deposits are for Non-resident Indians but remember both are for Indian Citizens. Indian banks, both private banks e.g. ICICI, HDFC, Kot…

Read more

Well, I am not an analyst, who can say that whether it's right time to invest in gold or not, but since I am a common man like many others, which follows some simple rules while investing money and follows principle of diver…

Read more

With Rupee falling every day and touching a new all-time low of almost $1 to Rs 83, many of NRI Indians are asking this question, is it a right time to transfer money to India or is it the right time to invest in FCNR deposits …

Read more

PM Modi has launched several good financial schemes e.g. Atal Pension Yojna to provide retirement solutions to many peoples from un-organized sector, PradhanMantri Jan Dhan yojana to open bank accounts for poor, Pradhan Mantri …

Read more

One of the most common doubts among every new NRIs mind is whether they need to file income tax returns in India or not. As I told earlier that it's not mandatory to file an income tax return in India , but now questions co…

Read more

Many NRIs buy property in India by taking NRI home loans, but when it comes to tax saving, most of them are not sure whether they are eligible for any tax saving in India or not. They just earned in abroad and replay the home lo…

Read more

One of the bad thing about Fixed deposits are TDS, i.e., tax deducted at source. If you don't pay attention to TDS or doesn't do enough to prevent or avoid TDS, you could lose the right amount of your interest income to …

Read more

NRIs (Non Resident Indian) are allowed to open bank accounts in India, and by knowing features and the tax benefit of different types of NRI accounts, you can save the right amount of money. There are three types of accounts an…

Read more

Many NRIs are not aware of income tax laws in India and doesn't know whether they have to file income tax returns in India or not. Sometimes they also wonder, do they have to include income earned in the USA as well or only …

Read more

Yes, both NRIs and Resident can remit the money obtained by selling properties in India, but you have to take a couple of things in your mind. For example, the sale proceeds amount must be deposited into NRO account , it cannot …

Read more

One of the common doubt among NRIs who are filing their income tax returns in India is to whether to declare foreign bank accounts and assets or not . I often receive comments and questions whether it's mandatory for an NRI …

Read more

Does it necessary for NRI to File Income Tax Return in India? One of the most common doubt every NRI has is whether its mandatory for them to file incomes tax return in India or not? Short answer is, it depends . If you are a…

Read more

Due to high interest rate offered by Indian banks for NRI customer there is a lot of interest on FCNR and NRE Fixed deposits and I am receiving query like can I break my FCNR deposit before maturity almost everyday now. It depend…

Read more

Even though both Wire transfer and ACH are ways to send a large amount of money from one place to another, there are some significant differences in the way they operate. A wire transfer, also commonly referred to as SWIFT trans…

Read more

If you are an NRI and have income in India like rental income and your annual income is more than 2.5 lakh, the basic exemption limit then you can reduce your taxable income by investing in an NRO tax saver fixed deposit . NRO t…

Read more

Hello guys, if you are looking for a long-term, tax-saving option to put your hard-earned income then you have come to the right place. While there are a lot of tax-saving options available to NRIs and Indians in India the…

Read more

![Which Documents Required for opening Sukanya Samriddhi Yojna Account In India? [List]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgEtTTCjRbcXlKnG6_OszWNxvdqkY3IqUoS126PDtvJmjGACTfMTjxPbhVadEbv4TyJRj6StfvSJl_3p7oTzw-J5nj3ZPNfC1ZATwiNRR41EJhX-ZQuSM2PS9tmayCKodcVkU4Y-ran6zk/w557-h731/Sukanya+Samriddhi+Account+Form+PDF.png)

![Can You break FCNR Fixed Deposit before Maturity? [Answered]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgFPB1al9aViEuOZUvJ4VMmAEs6umzNXqsDHo5jxhw8CgY07-neq0PXUjvd7qX_CdZKnNQCYM4JsrchK_wTcwh-MqhjOPm4ZOOtirOxDnprQeS__EQiwBc-E61vn23rs4QDcwU7aJiNq6E/s1600/FCNR+fixed+deposit+premature+withdrawl+penalty.jpg)