The answer is both Yes and No , it depends on the source of funds. Technically, Yes, you can deposit INR or Indian rupees in NRE account in India with both private banks e.g. HDFC, ICICI, Kotak, YesBank, Federal Bank, and any p…

Read more

After India's great demonetization drive, NRIs are worried about taking cash overseas. I often received queries regarding this and one of the common ones is, how much Indian currency an NRI can take to India from Overseas? T…

Read more

In theory, there is absolutely no limit to how much money you can send to India, provided you earned your money legally and paid your taxes but the USA is special. In practice, depending upon which channel you are using for send…

Read more

The Indian Customs limits on the amount of cash anyone can carry from abroad to India is different for Indian currency (INR) and foreign currency e.g. US Dollars, Pound or Yen. The cash limit for traveling in India is also diffe…

Read more

When a young software engineer gets his first onsite opportunity, whether it's short-term or long-term, he is full of excitement. Nothing beats the excitement and adventure of going abroad, especially in America or Europe. A…

Read more

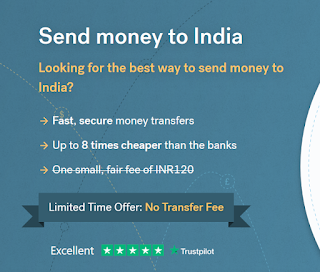

There are several ways to send money to India from Overseas, both online and offline. Some of the popular channel for remitting money includes the Western Union for the small amount of cash to online services like ICICI Money2In…

Read more

Do I need to Pay Taxes in India When I transfer money from an Overseas bank to India? Many of my IT friends are working abroad and when you go abroad the first time, you have a lot of queries in your mind, related to NRI status…

Read more

Remit2India, one of the popular remittance services among NRIs has recently launched an instant money transfer service from Australia to India. This means now you can remit money instantly, earlier it used to take 2 days. Along …

Read more

This is one of the frequently asked questions from NRIs, main from those who have not yet opened any saving account in India. NRIs (Non-Resident Indians) can open different types of bank accounts in India e.g. NRE (Non Resident…

Read more

TL;DR: You can now invest more than 1 lakh rupees on your PPF account , thanks to the increased limit in the 2014 budget . Earlier this limit was only 1 lakh but now it is raised to 1.5 lakh and so without doing any extra trick…

Read more

![Can NRI deposit INR in NRE Account in India? [Answered]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiyNMH-k4-PVlOfd65Ggfeo8WHACFakP4r4Qx8b4ANEgydO3imZIsY1_TNB7CVgqeXG5Nj9nPXSb_0KbJi3vMx92FGEQIHIqsV2H_z7RiLWaoSKByUWYzpbKfmG00M7YLf-7DKLhlaqZYQ/w629-h354/Can+NRI+deposit+INR+on+NRE+account.png)