India is getting prosperous and foreign trip are not a privilege only rich people had in the past. Nowadays, many middle and upper-middle-class Indians are traveling abroad for holidays, vacations, honeymoons, study and just for work to nearby countries e.g. Singapore, Malaysia, Dubai, Thailand etc. Apart from the hassles of getting Passport and VISA, one more thing which bothers many Indians is the customs rules and the worry about what they can carry back to India without paying customs duty while shopping overseas.

Every passenger has some free allowances which entitle him to bring many personal items and gift back to India without paying customs duties. If you know those free allowances and baggage rules you can make your trip more pleasant by avoiding custom declaration form and visit red channels.

These are some of the common rules which I know by experience and reading but the most important things are that the rules keep changing and you have to check with the official customs website and the airline you are traveling for most up-to-date information.

Btw, below list contains rules based upon the modification done on baggage rules and free allowances on 2016.

1. You can only carry 200 Citrates, 50 Cigars and 250 grams of Tobacco without declaration, that's the free allowance. If you carry more than that then you need to declare them by filling the customs declaration form.

2. The passenger of 18 years and above from anywhere e.g. Indians or Foreigners can carry one laptop computer or a notebook. You don't need to declare that on the customs form.

3. You can also buy 2 liters of Alcohol, liquor, or wines from duty-free shops. That's the maximum you can carry as part of your free allowance.

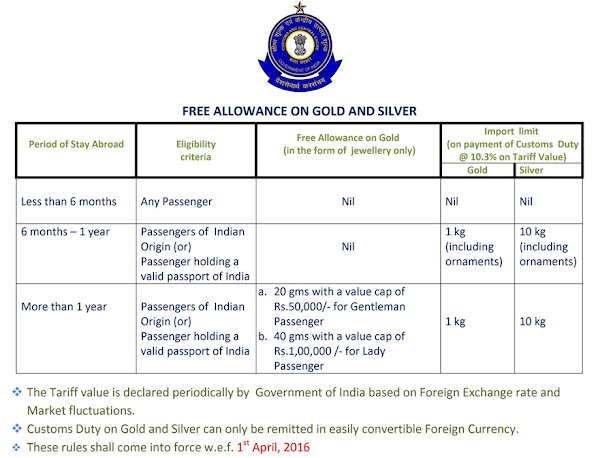

4. An Indian passenger who has been living abroad for more than 1 years can carry gold Jewelry without declaration under a limit. The limit on gold jewelry is different for male and female passengers. Ladies can carry 40 grams of gold jewelry with a value cap of 1,00,000 INR, while gents can carry 20 grams of gold jewelry with a value cap of 50,000 INR.

5. Indian citizens, NRIs, PIOs are allowed to carry less than 10,000 INR as cash without declaration, but this rule is not applicable for infants e.g. you cannot carry 50,0000 INR without declaring to customs if you are traveling with infants.

6. The Duty-free allowance for tourists of foreign origins is limited to 15,000 INR. If you are carrying goods above that then you need to declare that to customs. This limit was revised on 2016 and increased from 8,000 to 15,000 INR.

7. The duty-free allows for an Indian resident or a foreigner residing in India, or a tourist of Indian origin, coming from any country other than Nepal, Bhutan, or Myanmar is Rs 50,0000. You can bring personal items, travel souvenirs, gifts, and articles other than the prohibited ones, up to the value of Rs 50,000. This is also your baggage allowance. Also, remember that the free baggage allowance of one passenger cannot be combined with the free allowance of another passenger.

8. You need to fill the customs declaration form and report to Customs officer on Red Channel in case you are bringing prohibited articles, Gold Jewelry over the free allowance, Gold Bullion, Meat and Meat products, dairy products, fish or poultry products, and satellite phone.

9. You also need to see custom officer if you are bringing seeds, plants, fruits, flowers or other planting materials.

10. For cash, you need to declare to customs when you are carrying more than Rs 10,000, Foreign currency notes exceeding US$ 50000 or equivalent, or Aggregate value of foreign exchange e.g. traveler's cheques, including currency exceeds 10,000 USD or equivalent. You can see my articles on customs rules for carrying cash for more details.

That's all about some of the important Customs rules every Indian traveling abroad should know. If you want a hassle-free foreign trip or journey then you should follow these rules. All passengers who carry baggage within the allowance will not be required to fill the customs declaration form that is given by various airlines.

Btw, the rules are different for those NRIs who are coming back to India for good. The value of the duty-free personal and household items depends upon how long they have spent in overseas. The value ranges from a minimum of 60,000 INR to a maximum of 5,00,000 INR.

If you happen to bring good which exceeds these free allowance then you need to pay customs duty, which is charged very high and little bit complex. Last I know it was charged around 35% + cesses but after GST this might have affected. Fortunately, there is a customs duty calculator available on Indian customs official site, which you can use to calculate the exact custom duty you need to pay.

You also need to be aware of prohibited items while traveling. You can find the list on customs website or different Airline website, I'll also post my list soon.

References

Indian Customs Baggage Rules 2016

Custom Duty Calculator

Every passenger has some free allowances which entitle him to bring many personal items and gift back to India without paying customs duties. If you know those free allowances and baggage rules you can make your trip more pleasant by avoiding custom declaration form and visit red channels.

These are some of the common rules which I know by experience and reading but the most important things are that the rules keep changing and you have to check with the official customs website and the airline you are traveling for most up-to-date information.

Btw, below list contains rules based upon the modification done on baggage rules and free allowances on 2016.

Important Customs, Baggage Rules, and Free Allowances

Here is my list of some of the most common customs and baggage rules and free allowances which every Indian returning from abroad or foreign tourist traveling India should know. The government has revised the free allowance rules on March 1, 2016, and these rules are effective from April 1, 2016.1. You can only carry 200 Citrates, 50 Cigars and 250 grams of Tobacco without declaration, that's the free allowance. If you carry more than that then you need to declare them by filling the customs declaration form.

2. The passenger of 18 years and above from anywhere e.g. Indians or Foreigners can carry one laptop computer or a notebook. You don't need to declare that on the customs form.

3. You can also buy 2 liters of Alcohol, liquor, or wines from duty-free shops. That's the maximum you can carry as part of your free allowance.

4. An Indian passenger who has been living abroad for more than 1 years can carry gold Jewelry without declaration under a limit. The limit on gold jewelry is different for male and female passengers. Ladies can carry 40 grams of gold jewelry with a value cap of 1,00,000 INR, while gents can carry 20 grams of gold jewelry with a value cap of 50,000 INR.

5. Indian citizens, NRIs, PIOs are allowed to carry less than 10,000 INR as cash without declaration, but this rule is not applicable for infants e.g. you cannot carry 50,0000 INR without declaring to customs if you are traveling with infants.

6. The Duty-free allowance for tourists of foreign origins is limited to 15,000 INR. If you are carrying goods above that then you need to declare that to customs. This limit was revised on 2016 and increased from 8,000 to 15,000 INR.

7. The duty-free allows for an Indian resident or a foreigner residing in India, or a tourist of Indian origin, coming from any country other than Nepal, Bhutan, or Myanmar is Rs 50,0000. You can bring personal items, travel souvenirs, gifts, and articles other than the prohibited ones, up to the value of Rs 50,000. This is also your baggage allowance. Also, remember that the free baggage allowance of one passenger cannot be combined with the free allowance of another passenger.

8. You need to fill the customs declaration form and report to Customs officer on Red Channel in case you are bringing prohibited articles, Gold Jewelry over the free allowance, Gold Bullion, Meat and Meat products, dairy products, fish or poultry products, and satellite phone.

9. You also need to see custom officer if you are bringing seeds, plants, fruits, flowers or other planting materials.

10. For cash, you need to declare to customs when you are carrying more than Rs 10,000, Foreign currency notes exceeding US$ 50000 or equivalent, or Aggregate value of foreign exchange e.g. traveler's cheques, including currency exceeds 10,000 USD or equivalent. You can see my articles on customs rules for carrying cash for more details.

That's all about some of the important Customs rules every Indian traveling abroad should know. If you want a hassle-free foreign trip or journey then you should follow these rules. All passengers who carry baggage within the allowance will not be required to fill the customs declaration form that is given by various airlines.

Btw, the rules are different for those NRIs who are coming back to India for good. The value of the duty-free personal and household items depends upon how long they have spent in overseas. The value ranges from a minimum of 60,000 INR to a maximum of 5,00,000 INR.

If you happen to bring good which exceeds these free allowance then you need to pay customs duty, which is charged very high and little bit complex. Last I know it was charged around 35% + cesses but after GST this might have affected. Fortunately, there is a customs duty calculator available on Indian customs official site, which you can use to calculate the exact custom duty you need to pay.

You also need to be aware of prohibited items while traveling. You can find the list on customs website or different Airline website, I'll also post my list soon.

References

Indian Customs Baggage Rules 2016

Custom Duty Calculator

Other NRI Articles you may like

Thanks for reading this article so far. If you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.

- Is it mandatory for NRIs to pay income tax in India?

- Is it mandatory for NRIs to have Aadhaar card for tax payment?

- Do NRI required to link Aadhaar with PAN for income tax?

- Do NRIs and PIOs eligible for Aadhaar card?

- Difference between NRE, NRO, and FCNR account?

- Can you deposit INR in NRE account?

- Can you send money from NRO to NRE account in India?

Thanks for reading this article so far. If you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.