Ever since the income tax department of India made it mandatory to linked PAN card to Aadhaar card and ask every taxpayer to quote Aadhaar card number into the income tax return, many NRIs become worried. The reason was simple, most of them don't have Aadhaar card, but now Aadhaar card seems mandatory even for applying for PAN card. As far I know, from 1st July 2017 you cannot apply for PAN card without Aadhaar and without PAN card you cannot do a transaction involving more than 50,000 INR. So does this mean Aadhaar Card is mandatory for NRIs, PIOs, and OCI card holder?

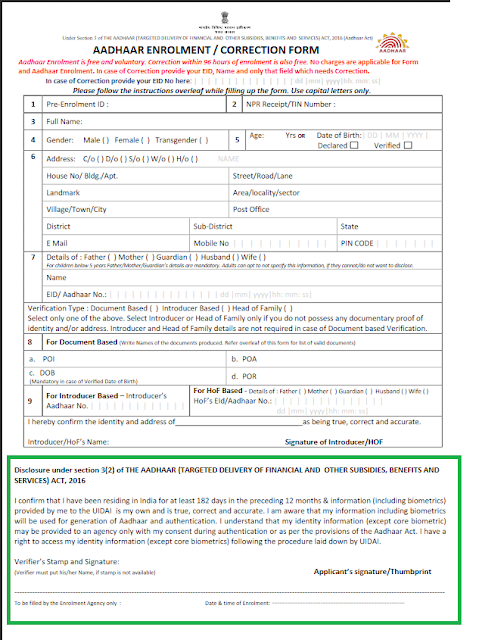

Well not really, in fact, NRIs are not even eligible for Aadhaar card because they are currently not staying in India. As per Aadhaar Act 2016, only a resident individual can apply for Aadhaar card i.e. a person who has stayed in India for more than 182 days in last 12 month. You need to make this declaration while applying for Aadhaar card and you can see that in the declaration part of the Aaddhar application form, as shown below:

Since NRIs, live outside India, they are not eligible for Aadhaar number, hence it is not mandatory for NRIs to quote Aadhaar Number while filing income tax return or while applying for PAN card after 1st July 2017.

Sine NRIs are not eligible for Aadhara card itself, they are also exempted from quoting Aadhaar number in their income tax return, which is mandatory for every other income taxpayer.

They are also exempted from linking PAN to Aadhaar card but only if they don't have any Aadhaar card yet and they don't want to apply for it in near future. But if you have both PAN card and Aadhaar card, it's better to link them to avoid getting your PAN card canceled.

From July first week Income tax of India is sending emails to all taxpayers, including both NRIs and resident Indians to link their PAN card with Aadhaar card. Thankfully you can do it online in just a couple of steps. here is a step by step guide to link your Aadhaar number with PAN number online without even login into income tax portal, which is a troublesome process because you need to signup first.

Well not really, in fact, NRIs are not even eligible for Aadhaar card because they are currently not staying in India. As per Aadhaar Act 2016, only a resident individual can apply for Aadhaar card i.e. a person who has stayed in India for more than 182 days in last 12 month. You need to make this declaration while applying for Aadhaar card and you can see that in the declaration part of the Aaddhar application form, as shown below:

Since NRIs, live outside India, they are not eligible for Aadhaar number, hence it is not mandatory for NRIs to quote Aadhaar Number while filing income tax return or while applying for PAN card after 1st July 2017.

NRI and Aadhaar Card

Aadhar card is similar to social security number in the USA and Canada. It is a 12 digit unique number provided by UIDAI to resident Individual in India. Anyone with age of more than 15 years can get Aadhaar number including foreigners, PIOs, and OCI holder, provided they are currently staying in India for more than 182 days in last 12 month from the date of enrollment.Sine NRIs are not eligible for Aadhara card itself, they are also exempted from quoting Aadhaar number in their income tax return, which is mandatory for every other income taxpayer.

They are also exempted from linking PAN to Aadhaar card but only if they don't have any Aadhaar card yet and they don't want to apply for it in near future. But if you have both PAN card and Aadhaar card, it's better to link them to avoid getting your PAN card canceled.

From July first week Income tax of India is sending emails to all taxpayers, including both NRIs and resident Indians to link their PAN card with Aadhaar card. Thankfully you can do it online in just a couple of steps. here is a step by step guide to link your Aadhaar number with PAN number online without even login into income tax portal, which is a troublesome process because you need to signup first.

Adhar card is another head-ache in India. Even to open NRE account one HDFC bank Manager asked me for Adhar card!

ReplyDelete