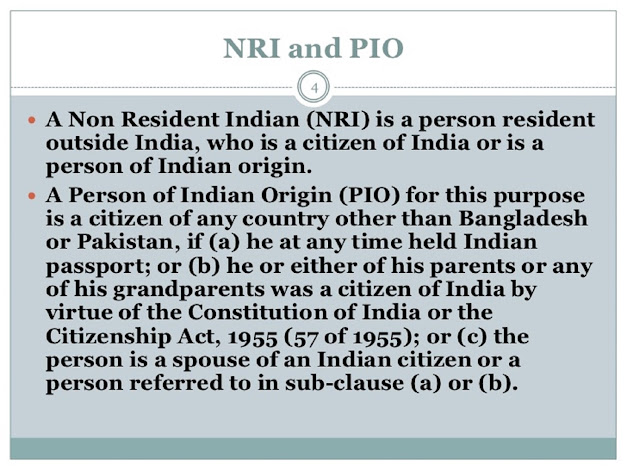

Though both NRI and POI are used to refers Indians living and working abroad and they have more or less similar rights to open a bank account, buy properties in India and restrictions e.g. not allowed to buy agriculture lands, there is some difference in terms of citizenship and origin. NRI stands for Non Resident Indian, whereas PIO stands for Person of Indian.

An NRI is an Indian citizen who stays outside India:

(a) for purposes of carrying out employment or any business or vocation;

(b) under circumstances indicating an intention to stay outside India for an uncertain duration;

(c) any Indian citizen deputed outside India for a temporary period in connection with employment

While a PIO is

A citizen of a foreign country (other than a citizen of Bangladesh or Pakistan) is a PIO if

(a) he/ she at any time held an Indian passport; OR

(b) he/ she or either of his/ her parents or any of his/ her grandparents was a citizen of India; OR

(c) spouse (not being a citizen of Bangladesh or Pakistan) of an Indian citizen or (a) or (b) above.

2) NRI holds the Indian passport while PIO holds the passport issued by a foreign country, he might have to hold Indian passport in past e.g. before accepting citizenship of the foreign country.

3) NRI doesn't need a visa to travel India, but PIO needs, well, they were issued PIO card which usually serves as lifetime visa.

4) NRI can vote if he is in India, but PIO cannot vote.

5) Both NRI and PIO cannot buy agriculture land in India.

a) Non-resident External (NRE) - both saving and fixed deposit accounts are allowed

b) Non-resident Ordinary (NRO) - both saving and FD are allowed

c) Foreign currency non-resident (FCNR) - only fixed deposit

See here to learn more about the difference between NRE, NRO and FCNR accounts.

That's all about the difference between an NRI and a POI. The main difference is citizenship, an NRI is still an Indian citizen and holds an Indian passport while a PIO is not an India citizen and doesn't hold an Indian passport.

Though he might have been holding one before e.g. if a person gets citizenship of any other country e.g. Australia he has to surrender his Indian passport.

He will then be issued an Australian passport, now he is no longer an NRI but becomes a PIO because he holds an Indian passport in past.

If you are settling down abroad e.g. in Singapore, Australia, New Zealand or the UK where dual citizenship is not allowed it's better to become PIO. You will be issued a PIO card which allows you to do things an NRI can do e.g. opening an NRE bank account, investing in Indian stock market, buying residential property in India e.g. flats. You will also be given a lifetime visa to enter India anytime.

Other NRI queries you might haveAn NRI is an Indian citizen who stays outside India:

(a) for purposes of carrying out employment or any business or vocation;

(b) under circumstances indicating an intention to stay outside India for an uncertain duration;

(c) any Indian citizen deputed outside India for a temporary period in connection with employment

While a PIO is

A citizen of a foreign country (other than a citizen of Bangladesh or Pakistan) is a PIO if

(a) he/ she at any time held an Indian passport; OR

(b) he/ she or either of his/ her parents or any of his/ her grandparents was a citizen of India; OR

(c) spouse (not being a citizen of Bangladesh or Pakistan) of an Indian citizen or (a) or (b) above.

Differences between an NRI and a PIO:

1) NRI is an Indian citizen while PIO holds foreign citizenship.2) NRI holds the Indian passport while PIO holds the passport issued by a foreign country, he might have to hold Indian passport in past e.g. before accepting citizenship of the foreign country.

3) NRI doesn't need a visa to travel India, but PIO needs, well, they were issued PIO card which usually serves as lifetime visa.

4) NRI can vote if he is in India, but PIO cannot vote.

5) Both NRI and PIO cannot buy agriculture land in India.

What type of bank accounts can be opened by NRIs or PIOs

Both NRI and POI can open following types of bank accounts in India with both public and private sector banks e.g. SBI or ICICIa) Non-resident External (NRE) - both saving and fixed deposit accounts are allowed

b) Non-resident Ordinary (NRO) - both saving and FD are allowed

c) Foreign currency non-resident (FCNR) - only fixed deposit

See here to learn more about the difference between NRE, NRO and FCNR accounts.

That's all about the difference between an NRI and a POI. The main difference is citizenship, an NRI is still an Indian citizen and holds an Indian passport while a PIO is not an India citizen and doesn't hold an Indian passport.

Though he might have been holding one before e.g. if a person gets citizenship of any other country e.g. Australia he has to surrender his Indian passport.

He will then be issued an Australian passport, now he is no longer an NRI but becomes a PIO because he holds an Indian passport in past.

If you are settling down abroad e.g. in Singapore, Australia, New Zealand or the UK where dual citizenship is not allowed it's better to become PIO. You will be issued a PIO card which allows you to do things an NRI can do e.g. opening an NRE bank account, investing in Indian stock market, buying residential property in India e.g. flats. You will also be given a lifetime visa to enter India anytime.

Is it mandatory for NRIs to pay income tax in India?

Is it mandatory for NRIs to have Aadhaar card for tax payment?

Do NRI required to link Aadhaar with PAN for income tax?

Do NRIs and PIOs eligible for Aadhaar card?

Difference between NRE, NRO, and FCNR account?

Can you deposit INR in NRE account?

Can you send money from NRO to NRE account in India?

Thanks for reading this article so far. If you like this article then please share with your friends and colleagues. If you have any questions or feedback then please drop a note.

Does the interest from NRE account opened by a PIO (Person of Indian Origin) tax-free similar to the NRE account opened by a NRI (Non Resident Indian)?

ReplyDelete