One of the most common doubt among Non Resident Indians related to NRI accounts are, what will happen to their NRE, FCNR, and NRO account when they return back to India? Even though you are not coming back in near future its good to know what happens to NRI account when you are no longer Non Resident Indian. When an NRI returns to India for permanent stay his various NRI accounts are converted into equivalent resident accounts. NRO saving account is converted back to resident saving account while NRE and FCNR account is converted into RFC (Resident Foreign currency) account.

NRE fixed deposits can continue to run till maturity at the contracted rate of interest should you decide not to break them. After maturity, NRE and FCNR fixed deposit account will be converted to RFC account.

If you are returning India for good but don't have any NRE or FCNR account but have foreign currency and can go back abroad after some time then you can also open RFC (Resident Foreign currency) account. Any returning NRI who was living abroad earlier and now returning India for permanent stay can open RFC account.

Now the question comes, Why you should open RFC account? What is the benefit of opening RFC accounts? Well, the main benefit of RFC account is that you can keep your foreign currency on that account, which means you don't need to suffer exchange losses if exchange rates are not in your favor. Similarly, when your FCNR gets converted to RFC there are no exchange losses. This is best for those people who still need to support their children studying or living abroad.

Also RFC account has one unique benefit depending upon how long you stayed abroad. If an NRI was living overseas continuously for a period of 9 years out of previous 10 years then there will be no tax on interest earned on RFC accounts for next 2 years.

If NRI regain his NRI status back then the balances in RFC account be converted into NRE/FCNR deposits as well. This is really a good option if you are working in IT and has to go back again to US or UK after a brief period in India. you can also open RFC term deposits for short term e.g from 30 days to 6 months.

In short, when an NRI returns back to India his NRI accounts like NRE, NRO, and FCNR are designated into resident accounts. Since NRO account is similar to saving accounts they are converted back to resident saving account but NRE and FCNR accounts are converted to RFC account which allows you to keep foreign currency with Indian banks even if you are not NRI.

You can continue your NRE fixed deposit with a contracted rate until maturity and when it matures it will automatically be converted into an RFC account, same is true for an FCNR account as well. If you stayed abroad for 9 years in the previous 10 years then the interest earned on the RFC account is also tax-free for another 2 years.

NRE fixed deposits can continue to run till maturity at the contracted rate of interest should you decide not to break them. After maturity, NRE and FCNR fixed deposit account will be converted to RFC account.

If you are returning India for good but don't have any NRE or FCNR account but have foreign currency and can go back abroad after some time then you can also open RFC (Resident Foreign currency) account. Any returning NRI who was living abroad earlier and now returning India for permanent stay can open RFC account.

Now the question comes, Why you should open RFC account? What is the benefit of opening RFC accounts? Well, the main benefit of RFC account is that you can keep your foreign currency on that account, which means you don't need to suffer exchange losses if exchange rates are not in your favor. Similarly, when your FCNR gets converted to RFC there are no exchange losses. This is best for those people who still need to support their children studying or living abroad.

Benefits of RFC Accounts for Returning NRIs

Another benefit of RFC account is that balance in this account can be used for local payments and can be remitted back to abroad for bonafide purpose e.g. if you son or daughter is studying in abroad you can transfer foreign currency to them directly from this account, saving exchange conversion charges.Also RFC account has one unique benefit depending upon how long you stayed abroad. If an NRI was living overseas continuously for a period of 9 years out of previous 10 years then there will be no tax on interest earned on RFC accounts for next 2 years.

If NRI regain his NRI status back then the balances in RFC account be converted into NRE/FCNR deposits as well. This is really a good option if you are working in IT and has to go back again to US or UK after a brief period in India. you can also open RFC term deposits for short term e.g from 30 days to 6 months.

What happens to your NRI accounts when you return back?

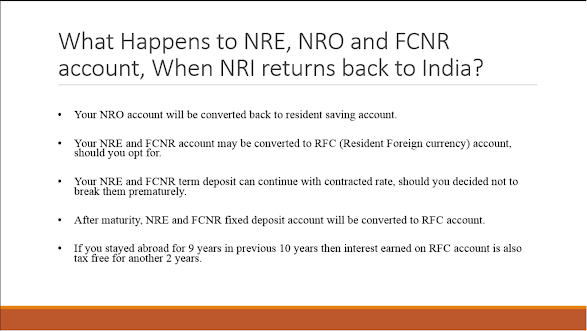

Here is what will happen to your NRI bank accounts when you return to India and become Indian resident from tax filling purpose:- Your NRO account will be converted back to resident saving account.

- Your NRE and FCNR account may be converted to RFC (Resident Foreign currency) account, should you opt for.

- Your NRE and FCNR term deposit can continue with contracted rate, should you decided not to break them prematurely.

- After maturity, NRE and FCNR fixed deposit account will be converted to RFC account.

- If you stayed abroad for 9 years in previous 10 years then interest earned on RFC account is also tax free for another 2 years.

In short, when an NRI returns back to India his NRI accounts like NRE, NRO, and FCNR are designated into resident accounts. Since NRO account is similar to saving accounts they are converted back to resident saving account but NRE and FCNR accounts are converted to RFC account which allows you to keep foreign currency with Indian banks even if you are not NRI.

You can continue your NRE fixed deposit with a contracted rate until maturity and when it matures it will automatically be converted into an RFC account, same is true for an FCNR account as well. If you stayed abroad for 9 years in the previous 10 years then the interest earned on the RFC account is also tax-free for another 2 years.

Other NRE Fixed Deposit articles you may like

- Does Interest on NRE Fixed Deposit is Taxable?

- 10 Benefits of opening NRI Fixed Deposits in India?

- Can you Break NRE Fixed Deposit prematurely?

- Can you Open a Joint NRE or NRO Account with family?

- Can you add a nominee to your NRE or NRO Account?

- Difference between Resident and NRE fixed deposit

- How to open an NRE account in Singapore?

- Difference between NRE and NRO Fixed Deposit in India?

- Which banks offer higher interest on NRE Fixed Deposits

- When is a good time to interest in an NRE fixed deposit?

- Difference between Fixed and Recurring Deposit

Thanks for reading this article so far. If you find this information useful please share it with your friends and colleagues on Social media. You can also use the share button to share the articles on Twitter and Facebook.

Hi,

ReplyDeleteI have an NRE account & I came back to India on 30th July. I wanted to know that till what time my accounts remains as NRE & also I have created online fixed deposit before coming back to India & even after reached India. I wanted to know whether those FD will be treated as NRE FD (No tax to be deducted on those FD). Also can i open FD now as NRE to get tax benefit? I also inquired from Banks call centre & as per them I can premature my FD & that they will charge only penal rate. I wanted to know if I have to inform Bank that I am not going back to abroad because as per Banks call centre they will wait for 2 years (from date of my arrival) to convert my account as normal saving account.

Please revert.

Thanks.

Hello @Agyakar, It depends upon your residential status. If you have spent long time outside Indian in previous years then their is good chance that you will be RNOR (Resident but not Ordinary Resident) for next one to 2 years. RNOR enjoys same tax benefit as NRI i.e. their global income is not taxed in India, which also includes interest earned on NRE fixed deposits and FCNR accounts.

DeleteFor example, if you spent more than 182 days in a given financial year in India but you were an NRI in 9 out of preceding 10 years then you will be considered RNOR, which means you can keep your NRE and FCNR accounts.

You can check your actual residential status by following this NRI residential status chart or using ClearTax's NRI residential status calculator.

Can you please also clarify the status of NRE term desposits which were made before attaining an ordinary resident status...whether such NRE TDs will be considered as tax free until maturity or interest will be taxable from the moment when individual's resident status changed to ordinary resident of India.

DeleteHi Agyakar, I have similar case. Did you get the answer for how long the account can remain as NRE account once I have returned back to India for permanent stay. Please let me know.

ReplyDeleteHello @valokv, as longs as you are RNOR (Resident but not Ordinary Resident) after returning to India, your account can remain NRE account and you can enjoy tax free interest on your NRE fixed deposit. Depending upon how long the person has been in Overseas in previous year, he can be an RNOR for 2 to 3 years.

Deletesalary from unicef is credited to unfcu account in newyork.is it ok if my pension in us.$ is credited in us.$ into unfcu as I am retiring end april.

ReplyDeleteI have nre account in india. what happens to nre account. is there any account in indian banks where I can keep my pension in foreign currency

@D.K.Muarali, I doubt Indian banks provide foreign currency accounts for resident Indian but if you are an NRI you can keep your US local bank account. But, once you become resident Indian, you need to pay taxes on interest earned on your US dollar bank account as well.

DeleteIf you live in INDIA more than 180 days, then you become INDIAN RESIDENT for TAX purpose.. Until then you remain foreign resident for TAX purpose.

ReplyDeleteso I believe is that, what ever changes to your NRE account should happen after 180 days. (except to those who lived 9 out of 10 yrs abroad).

Before 180 days if you make Fixed deposits. I think they should consider as NRE FD until maturity..

I'm not accountant or Tax agent. what ever I mentioned above is my understanding after reading some of TAX rules in INDIA. I'm same like you guys NRE returning to INDIA with same questions.

@Anonymous, you are right in general but there are more details to it. It all depends upon the actual residential status of NRI. If he is an NRI or RNOR he can keep his NRE and FCNR account otherwise he has to convert them to resident bank accounts.

DeleteNow, how do you know your actual residential status i.e. whether you are an NRI, RNOR or an ordinary indian for a given financial year? You can use this NRI residential status calculator to calculate that.

i am a seafarer maintaining nri status by fulfilling about 186 days out of india (6 Months) and earning salary in foreign currency. Now i want to settle down in my hometown. Question is NRE (USD and Indian Rupee) account as per RBI requirement, how many years can be maintained?

ReplyDelete@Unknown, it depends upon your residential status, at max 2 to 3 years as long as your residential status is RNOR.

DeleteAs per RBI guidelines as of today, any type of non Resident accounts have a MAXIMUM of 180 days for conversion to resident accounts (if returning back to India permanently) or show proof to bank on continuation as NRI and keep status of accounts intact (this varies from bank to bank; SBI has a rule that you should show your visa and have the NRI status date extended as per visa expiration status)

ReplyDelete@Anonymous, that's in general but you can keep your NRE account as long as you are an RNOR too, by showing documents to SBI or any bank as per se.

DeleteI talked to SBI NRI bank manager, he told to convert nre account to sbi account if your stay in india more than six months and taxation will be as per indian tax.I asked manager that though i have finished 7 months but i am planning again may in 4 to 6 months then again same account can be coverted to NRE account, he replied that it can not be converted again to NRE and need to open new NRE account. Any body have idea in this case?

ReplyDeleteKetan

Hello Ketan, you need to convert your NRE account to resident saving account if you become Ordinary Indian Resident for that financial year. If you are an NRI or RNOR you can keep your NRE accounts and fixed deposits. An NRI can be an RNOR for 2 to 3 years since he came back. You can check your actual residential status by following this chart to see whether you quality NRI or RNOR, if not, you have to convert your NRE account to resident saving account.

DeleteI shall be very grateful if you could provide reference of the RBI Circular / Notification / Directive which allows NRE term deposits to continue with contracted rate, should the holder decide not to break them prematurely.

ReplyDeleteHello @Anonymous, you cannot keep it for longer but only till your resident status is RNOR. Once you become Resident India from Income tax perspective, they will be converted to normal FD and interested will be taxed. You can read more about Returning NRI, RFC Account and other from RBI here https://www.rbi.org.in/scripts/ECMUserChapterDetail.aspx?Id=391&CatID=13

DeleteIs interest earned on nre fixed depositsin India, taxable in USA?

ReplyDeleteHello @Anonymous, yes, interest earned on NRE fixed deposit is taxable in USA because the USA tax on global income for its tax resident.

DeleteI want to add one more point here regarding taxes for returning NRIs. It depends upon whether you are considered RNOR or Resident India for that year. You can find if you are RNOR by using the flow chart here http://savingsfunda.blogspot.com/2016/12/how-to-find-if-returning-nri-is-RNOR-and-tax-benefit.html. If you are RNOR then your global income will not be taxed, otherwise you need to pay tax on your global income which can be huge.

ReplyDeleteSir ,

ReplyDeleteCan I take with me foreign currency equivalent to 2,00,000 INR or less(pemissible under custom act) as going on Exit in 2 months ?

If so upto how many months am I allowded

By RBI to keep them ?

I want them ad they are easy to encash at Foreign currency exchange counters with producing passport.

Please see my reply below, you can also check my post https://savingsfunda.blogspot.com/2016/12/cash-limit-for-travelling-in-india.html for more details.

DeleteCould I permited to take with me foreign currency equivalent to 2 lakh INR or less while going on final exit from the gulf country ?

ReplyDeleteIf permited,till how many months can I keep them after arrival in India ?

I want to keep them for sometime as they served as liquid cash to get instant INR when needed at permited exchange counters in Airports or nationalised banks.

Hello C.S.Mishra, yes you can bring foreign currency equivalent to 2 lakh INR or less to India but I am not sure about gulf country customs. You may be required to declare that, different country has different rule but 2 lakh INR is close to 3500 USD which is quite less, but better be safe to check on the country's custom website where you are living.

DeleteWhen you come to India, you can bring as much foreign currency as you want but if total value is more than 10K USD then you need to declare to Customs. Yes, you can covert them to Airport or banks.

Dear Mr Javin Paul,

ReplyDeleteI have read all your information for returning NRIs & which is very helpul Thank you very much. I am also an NRI since 2004-05, now planning to return for permanent settlement in India. Like all others I also have many NRE FDs which will mature after 5 years after my return to India. Now I would request you to clarify '' is it true that Interest on NRE FDs will be Tax Free in India till one holds RNOR status'' & '' is it necessary to convert all NRE FDs to resident account FDs immediately after return OR immediately after loosing RNOR status''. Please check as there is no any clear clause either in FEMA or in RBI for these NRE FDs during RNOR status. I am not talking about RFC accounts as opening RFC account just for two years of RNOR status does not make any sense. Request you to put your kind effort in clarifying with proper supporting clauses if possible.

Thank you very much.

Rgds,

Rajanna.

Hello Ranjana,

DeleteThe whole point is that NRIs and RNOR are not taxed on their global income or income earned outside India. Source of NRE fixed deposit is always foreign income hence they are fully repatriable. That's why their not taxed until you become resident indian. Once you become that, you cannot hold NRE account, hence you need to convert them back to NRE FD, even if you don't they will be taxed because global income of resident indians are taxable in India.

Dear Javin Paul,

DeleteFrom your above expalantion it is clear that, interest from NRE FDs are not taxable til one enjoys the RNOR status. But, one confusion from your above lines is ''That's why their not taxed until you become resident indian. Once you become that, you cannot hold NRE account, hence you need to convert them back to NRE FD,here once I become residen then how can I convert them back to NRE FD.

However the point of tax on NRE FD interest during RNOR status is not fully supported by any of the banks which I recently communicated with banks.

HI I have worked in UK for the past 18 months, I haven't opened an NRE account. I will be leaving UK shortly. I have Savings account in India. Is it safe to transfer the money earned here to the savings account directly without having to pay any tax for it? Also if I have to deposit the money later from my savings account to an FD or invest in something else will be taxed for the principle amount?

ReplyDeleteThanks in advance for your help.