In my last post, can NRI invest in National Pension Scheme, I told you that NRIs are now allowed to open NPS accounts, it's time to share more information about NPS like why an NRI should invest in National Pension Scheme. One of the main reason NRI should open NPS account is to build their retirement or pension corpus in India. Since many NRI working abroad don't have any kind of social security, especially those who are working in middle east and gulf country. For all Non-resident Indians, this is now a golden chance to plan for their old age income.

Apart from retirement benefits, NPS offers some more incentives to encourage young NRIs to open account like NPS offers the additional benefit of 50,000 over and above the section 80C benefits. So if an NRI has taxable income in India, he can potentially save 50,000 INR more by investing in NPS.

Another advantage of opening NPS scheme is that you can repatriate the pension or annuity payment to overseas, there is no restriction on that. If these benefits sound good to you then you should consider opening an NPS account.

Apart from retirement benefits, NPS offers some more incentives to encourage young NRIs to open account like NPS offers the additional benefit of 50,000 over and above the section 80C benefits. So if an NRI has taxable income in India, he can potentially save 50,000 INR more by investing in NPS.

Another advantage of opening NPS scheme is that you can repatriate the pension or annuity payment to overseas, there is no restriction on that. If these benefits sound good to you then you should consider opening an NPS account.

It's one of the better presents you can give to yourself on your birthday. Btw, resident Indians can also add NPS along with other tax saving options available for salaried employees.

1. First thing is eligibility, all NRIs who are more than 18 years old and less than 60 years of age can open an NPS account. Btw, the account needs to be opened by the individual NRI himself as a power of attorney is not allowed.

2. The second thing is how to open the NPS account, where to get the application form? Well, in order to open an NPS account you need to fill the NPS subscriber registration form. You can download this from the NPS website or obtain it from any POP-SP (Point of Presence), all major banks act as POP for NPS e.g. ICICI and SBI. You can open your NPS account by just visiting your local ICICI bank branch.

3. The third thing is what documents are required to open NPS account by NRIs? Well like the bank account, you need to fill the subscriber registration form and present KYC documents like Id proof and address proof. You need to provide both overseas and Indian permanent address, though.

10 points about Nation Pension Scheme (NPS) Account NRIs

Here are all the things an NRI needs to know to open an NPS account1. First thing is eligibility, all NRIs who are more than 18 years old and less than 60 years of age can open an NPS account. Btw, the account needs to be opened by the individual NRI himself as a power of attorney is not allowed.

2. The second thing is how to open the NPS account, where to get the application form? Well, in order to open an NPS account you need to fill the NPS subscriber registration form. You can download this from the NPS website or obtain it from any POP-SP (Point of Presence), all major banks act as POP for NPS e.g. ICICI and SBI. You can open your NPS account by just visiting your local ICICI bank branch.

3. The third thing is what documents are required to open NPS account by NRIs? Well like the bank account, you need to fill the subscriber registration form and present KYC documents like Id proof and address proof. You need to provide both overseas and Indian permanent address, though.

You also need to provide a copy of your passport and local address proof if the address is different from the address given in passport. Once you submit the form, you can check the status of your application online by visiting https://cra-nsdl.com/CRA/ by using the 17 digit receipt number provided by POP-SP or the acknowledgement number allotted by CRA-FC (Facilitation Centre) at the time of submission of application forms by POP-SP.

4. After the successful opening of NPS account, similar to PAN card, you will be given a PRAN number (Permanent Retirement account number), which is unique for each account holder and will be valid for life time.

5. Now, you have got the NPS account opened, next question is how do deposit money on NPS account or how to make your contribution, Well NRI can make a contribution to their NPS account from their NRE or NRO saving the account, it's simple, easy and fast.

6. NRI can select the pension fund manager from 8 stipulated funds including big mutual fund house like ICICI Prudential etc

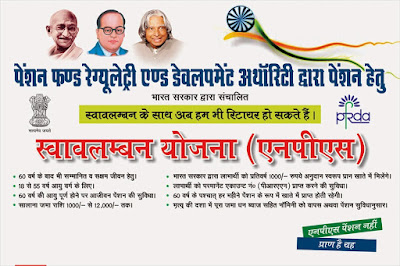

Here is an advertisement was given by PFRDA, the regulatory authority of National Pension Scheme, also known as NPS, or New Pension Scheme or Swavlamban Yojna in Hindi

That's all about Why NRI should open NPS account and How can they open National Pension Scheme account. Currently, NPS has more than 93 lacs subscriber. You have also learned the eligibility criterion, document required and how to check the status of NPS account online.

4. After the successful opening of NPS account, similar to PAN card, you will be given a PRAN number (Permanent Retirement account number), which is unique for each account holder and will be valid for life time.

5. Now, you have got the NPS account opened, next question is how do deposit money on NPS account or how to make your contribution, Well NRI can make a contribution to their NPS account from their NRE or NRO saving the account, it's simple, easy and fast.

6. NRI can select the pension fund manager from 8 stipulated funds including big mutual fund house like ICICI Prudential etc

Here is an advertisement was given by PFRDA, the regulatory authority of National Pension Scheme, also known as NPS, or New Pension Scheme or Swavlamban Yojna in Hindi

That's all about Why NRI should open NPS account and How can they open National Pension Scheme account. Currently, NPS has more than 93 lacs subscriber. You have also learned the eligibility criterion, document required and how to check the status of NPS account online.

Even if you are not concerned about your retirement or pension fund, investing in NPS is still lucrative because of the additional 50K benefit it offers over Section 80C. If you are an NRI paying tax in India than opening NPS account can definitely save some money for you.

Other NRI Banking Articles you may like

- Is NRO Account Taxable in India?

- How to appoint a mandate holder in NRE Account?

- What happens to the NRE account when you return to India?

- Is it mandatory to open NRI accounts?

- Can you break FCNR Fixed deposit before maturity?

- Can you repatriate money from the NRO account overseas?

- NRE, NRO, or FCNR? Which is the right account for NRIs?

- Difference between NRE and NRI Account?

Hi Brother !! Here is a question and request you to look into and advise in the matter

ReplyDeletei.e. in the eventuality, after opening and continuing the NPS account as NRI in view of what is stated bove, if the NRI becomes a RESIDENT of USA/Canada in course of time, then what will be the position of [i] the NPS account [ii] the funds so far remited into NPS account [iii] other incidential effects for the NPS account. KINDLY ADVISE. Thank you. = svgd1951@gmail.com

How to calculate long term capital gain on property/house sale with example.

ReplyDeleteYes, both NRIs and Resident can remit the money obtained by selling properties in India, but you have to take a couple of things in your mind. For example, the sale proceed amount must be deposited into NRO account, it cannot be deposited into NRE account. Similarly, you may be liable to pay the short term or long term capital gains while selling property situated in India. If you are selling the property within 3 years of purchase then you need to pay short tem capital gain and if you are selling the house after 3 years then you have to pay long term capital gains i India. In case you have inherited the property then the date of purchase and price of purchase of previous owner will be used for calculation.

The long term capital gains are taxed @ rate of 20% while short term capital gains are taxed at th applicable income tax slab rates for the NRI. Long term capital gain on property sale is not easy to calculate because you need to first calcualte the indexation factor, which is the CII of year of the sale divided by the CII of the year of purachese.

Once you calcualte the indexation factory, you can calculate the indexed cost of property purchase. The long term capital gain is the difference between the indexed cost of purchase and the sale price.

For example, if you have bought the property in 10 lakh in the year 2005 and now selling it on 50 lakh, then here is the formula for calculating long term capital gain on your property sale:

Cost Inflation Index, CII= Index for financial year 2016-17/Index for financial year 2005-2006 = 1125/480 = 2.343

Indexed cost of purchase = CII x Purchase Price = 2.343 x 10,00,000 = 23,43,000

Long-term capital gain = Selling Price – Indexed cost = 50,00,000 – 21,30,000 = Rs. 26,56,250

Tax on capital gain = 20% of 26,56,250 = 5,31,250

Here is one more example, of how long term capital gain taxes are calculated using indexation:

Suppose you purchased a plot of land in 2007 for Rs.20,00,000, which you sold in 2011 for Rs.60,00,000. What will be the actual profit you made on this sale? 40 lakhs? No, lower than that, let's see how it works

Cost of property purchase – 2007 20,00,000

Sale price of property – 2011 60,00,000

CII – 2007 551

CII – 2011 785

Indexed Cost Price 20,00,000 * (785/551) = Rs.26,42,468

Long Term Capital gain 60,00,000 – 26,42,468 = Rs.33,57,531

So, your actual profits after selling the property is not Rs. 40,00,000. It is only Rs. 33,57,531. This is the amount you need to consider for calculating your taxes. The long term capital gain would be 20% of that amount because you sold the property after 3 years i.e. Rs 6,71,506.

So, you can see that calculation of long term capital gain on property sell is not that streight forward and it depends upon Cost Inflation Index. Here is the full list of CFI.

The cost of inflation index (CII) has been notified by the Central Government every year by notification in the Official Gazette. The cost of acquisition/improvement will, thus, be indexed with reference the rate of applicable for the relevant year. The Cost of Inflation Index is mainly used to compute Long term capital gain.