Difference between NRE and NRO fixed deposit

NRI has two options to invest in Fixed deposit in India NRE fixed deposit and NRO fixed deposit, but you need to be careful whether you choose NRE or NRO fixed deposit as taxation rules on NRE and NRO Fixed deposit is different. Principle and Interest earned in NRE fixed deposits are completely tax-free while interest earned on NRO fixed deposits are subject to TDS and deduct at the maximum rate of 30%. Also, you can send rupees back to your overseas account if it is held in NRE fixed deposit, but you can not repatriate money from NRO fixed deposit.

In this article, we will see some differences between NRE and NRO fixed deposit opened with any Indian banks like ICICI, HDFC, SBI, or Kotak Bank and find out whether you should open NRE fixed deposit or choose NRO fixed deposit based upon your requirements.

In short, if you are opening a fixed deposit from overseas money by converting it into rupees then send it to your NRE saving account and create an NRE fixed deposit right there.

In this article, we will see some differences between NRE and NRO fixed deposit opened with any Indian banks like ICICI, HDFC, SBI, or Kotak Bank and find out whether you should open NRE fixed deposit or choose NRO fixed deposit based upon your requirements.

In short, if you are opening a fixed deposit from overseas money by converting it into rupees then send it to your NRE saving account and create an NRE fixed deposit right there.

On the other hand, if money is earned in Indian rupees via different income sources e.g. dividend or income from rent then you must have an NRO saving account to receive those amounts, use this amount to create an NRO fixed deposit.

In both cases, it's not good to leave money idle because they will earn fewer interest rates.

In both cases, it's not good to leave money idle because they will earn fewer interest rates.

Also, if you eventually thinking to repatriate or send money back to your overseas account, think of opening an FCNR fixed deposit, this will reduce your exchange conversion risk and you may yield better returns if the US dollar becomes stronger in the next few years.

Difference between NRE and NRO FD Accounts?

NRI can open both NRE and NRO FD in one bank and online by using his NRE or NRO Savings accounts but before opening NRE or NRO FD, you must know taxation rules related to both of them because that will make the difference in your overall interest gain or yield.

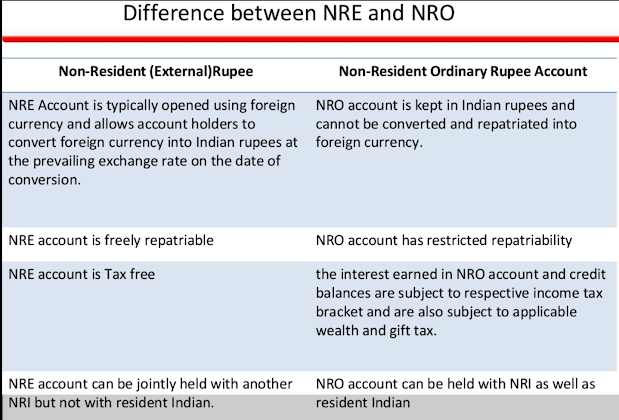

Here is a few notable difference between NRO and NRE fixed deposit:

1. Taxation

First and the major difference between NRE and NRO fixed deposit is that interest earned on NRO fixed deposit is taxable in India. it means you need to pay income tax on all the interest you earned in NRO fixed deposit with a rate of 30.9% which is quite higher, on there another hand interest earned on NRE fixed deposit is exempted from tax in India.This means you don't need to pay any income tax on the interest accrued in NRE fixed deposit. This difference alone is significant enough to choose NRE fixed deposit over NRO fixed deposit.

By the way, if you don’t have a lump sum amount to invest, you can take the benefit of an NRE or NRO Recurring deposit, to lock your money with higher interest rates and soaring exchange rates.

2. Fully repatriable

Another difference between NRE and NRO fixed deposit is that In the case of NRO fixed deposit you can not repatriate principle back to the foreign country, you can only transfer interest earned on NRO fixed deposit to the foreign country or abroad where you stay.On the other hand, NRE Fixed deposit allows you to transfer both principle and interest abroad. Everything from principle to interest earned is fully repatriable in NRE fixed deposit.

This is another significant difference between NRO and NRE fixed deposit which suggests choosing NRE over NRO FD. See here to learn more about repatriation.

3. Joint account with Indian parents

One more difference between NRE and NRO term deposit is that you can open NRO term deposit jointly with your family member which is not NRI, which means parents staying in India or any immediate family member staying in India can hold an NRO term deposit along with you.On the other hand NRE, term deposit can only be open jointly with another NRI, which is a kind of restriction if your family is staying in India. This can be a very important difference depending upon the personal situation of NRI.

If you are an unmarried software professional working abroad and want to open a joint fixed deposit then you can choose NRO fixed deposit over NRE fixed deposit.

If you want to keep your money on a foreign currency like USD, GBP, AUD, etc, you can also choose to open FCNR fixed deposit with HDFC Bank, ICICI, SBI, RBS, and Kotak Mahindra. FCNR deposits are free from exchange rate risk and also provide better interest rates than Fixed deposits with local foreign banks e.g. Citibank or Bank of America in the US and Canada

Here is a nice table which summarizes the difference between NRE and NRO fixed deposit account for any bank in India:

4.Interest rates

Another difference between NRO and NRE term deposits is their interest rates. Currently, the difference in interest rate is not much between NRE and NRO fixed deposit but if you see better interest offered in NRE fixed deposit then you can leverage that because both NRE and NRO fixed deposit holds money in Indian Rupees (INR).But just be cautious and read first few differences between NRE and NRO fixed deposit if you intention is to take money back to abroad because both NRE and NRO term deposit are subject to Currency risk.

If Exchange rates will not in your favor once your NRE or NRO FD matures then you might lose instead of gaining for depositing money in Indian Rupees for 3 years in India, on the other hand, you might get better returns if exchange rates turn into your favor.

Anyway, I suggest avoiding currency risk and only investing an amount that you definitely want to keep as Indian Rupee and don't want to repatriate.

There are other options available like FCNR Fixed deposit which allows you to keep money in foreign currency and get better returns than what is offered by foreign banks.

5. Depositing money

Another difference between NRE and NRO fixed deposit is How to transfer or deposit money? NRE fixed deposit can only be open by sending foreign currency cheques, remitting foreign currency directly to your NRE Saving account using money2India, remit2India, or click2Remit or any other remitting services.You can not open NRE fixed deposit by transferring Indian rupees from any other Resident or NRO Saving account. this is a restriction,

On the other hand, NRO Fixed deposit can be open by transferring money from an NRE Saving account or income earned in India, e.g. Rental income, Stock dividends, short-term capital gains, long-term capital gains, etc.

Here is a nice table which summarizes the difference between NRE and NRO fixed deposit account for any bank in India:

These were some of the important differences between NRE and NRO fixed deposit, which will help you to decide whether you should invest in NRE fixed deposit or open an NRO fixed deposit. Decide based upon your need and priority.

My suggestion is that if choose NRE fixed deposit over NRO fixed deposit t to get tax benefits and facility to send principle and interest back to foreign currency in case you're required. Chose NRO fixed deposit if you want to open a term deposit account jointly with your Non-NRI family members.

Other NRE Fixed Deposit articles you may like

- Does Interest on NRE Fixed Deposit is Taxable?

- 10 Benefits of opening NRI Fixed Deposits in India?

- Can you add a nominee to your NRE or NRO Account?

- Difference between Resident and NRE fixed deposit

- How to open an NRE account in Singapore?

- Which banks offer higher interest on NRE Fixed Deposits

- When is a good time to interest in an NRE fixed deposit?

- Difference between Fixed and Recurring Deposit

- Can you Break NRE Fixed Deposit prematurely?

- Can you Open a Joint NRE or NRO Account with family?

Thanks for reading this article so far. If you find this information useful please share it with your friends and colleagues on Social media. You can also use the share button to share the articles on Twitter and Facebook.

This is really good list to choose between NRE vs NRO fixed deposit. I didn't really know that there are two options for opening fixed deposit for NRI Indian and there is so much difference between NRE vs NRO fixed deposit. I heard about FCNR deposit as well, Can you also put similar points for NRE vs FCNR fixed deposit for 3 year tenor

ReplyDeleteIn these times of uncertain returns, fixed deposits have become the most recommended banking instruments for financial savings. MMFSL's new Fixed Deposit scheme assures you of highly competitive interest rates with this low-risk investment.

ReplyDeleteBonanza Portfolio Ltd, A leading Broking house in India brings you an Online Investment platform, http://www.bonanzafinmart.com/. Just make a one-time registration with us. In general terms investment means the use of money to make more money.This will keep a track of all the records and investments at one place which will help you to safeguard your investments.

I have found here much useful information for myself. Many thanks to the editors for the info.

ReplyDeleteMoney Transfer

These five differences between NRE and NRO are really authentic. My friend told me about this comparison and now I’m reading this post. It’s really amazing.

ReplyDeleteVCT

Good one

ReplyDeletePerfect one. I really found very useful

ReplyDeleteThanks @Anonymous, Glad to hear that you find this comparison of NRE and NRO fixed deposits useful.

Deletereally very useful,,thks for sharing.

ReplyDeleteGreat article explaining subtle differences. All my doubts have been cleared due to this clear article

ReplyDeleteDear Sir,

ReplyDeleteI am an NRI. Recently, a company share in which I had invested some years back, sold out and they credited my share amount in my NRO SB. Initial investment was made when I am NRI only.

Now will the bank deduct tds 30% on this 5 lakhs, which is 1,50,000/- huge. so how can I save this ? should I transfer the amount as gift to my parents or should I buy another equity linked policy?

Bank can not deduct TDS on this 5 lac amount... they are only authorized to deduct the TDS on the amount/interest you earn while your money in their account/bank.

Delete@Anonymous, Tax will only be on capital gain not the full amount and if you have sold your shares after 3 years, you don't need to pay any tax on this amount, but yes you need to file your income tax return. If that's not the case and you earned 5 lakhs as capital gain then also bank will not deduct as TDS. You can put some part of this money on ELSS and other investment vehicles to claim against section 80C. At the end, you need to pay tax on your taxable income.

ReplyDeleteVery useful info. thank you.

ReplyDeleteOne Important point...

ReplyDeleteAlthough interest earned on FD in NRE account is not taxable in India but it is taxable in US. In India, Bank will deduct TDS 30.9% but in US you may have to much more than that as taxes.

Interesting part is, you can claim back TDS deducted by the Bank by filing ITR. Upto 2 Lac or based on current exemptions as you may not have much earnings in India...

Hope you would like the idea.

Which bank offers highest NRE FD rates? I want to put Rs 50 lakh in NRE fixed deposit and looking for good bank with good NRE FD rates. Can you put a utility please

ReplyDeleteI use State Bank of India or any government bank for large FDs. The current rate of interest that the bank offers is between 7.25 to 7.5% for any deposits up to 365 days.The 7.5% is for those fixed deposits that are between 365 days and 2 years.

DeleteGovernment banks offer 7.25% for deposits up to 1 year and 7.5^% for deposits over 365 days. I use State Bank of India or Andhra Bank. As an NRI, having an account with a government bank also helps provide one address proof when renewing my passport, so it serves multiple functions.

DeleteKVB offers the highest 2% on FCNR , next SBH 1.8

ReplyDeleteSorry, what is KVB and SBH here? Never heard about them?

ReplyDeleteAre NRE interest taxable in Canada ?

ReplyDeleteThanks

Arjun