In this article, we will understand the difference between two of the best investment option of conservative investors, PPF or Public Provident Fund and Fixed Deposit, known as FD . Both PPF and FD provides the capital guarante…

Read more

Recently I was doing some research to open an NRI Savings account in India , and given there are so many banks, both public and private sector are providing NRI services, I thought to do some quick checks on the best NRI…

Read more

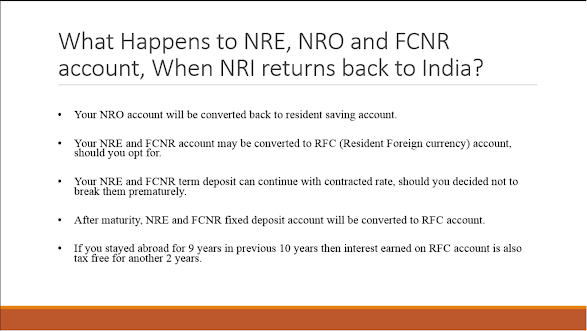

One of the most common doubt among Non Resident Indians related to NRI accounts are, what will happen to their NRE, FCNR, and NRO account when they return back to India? Even though you are not coming back in near future its go…

Read more

If you are an Indian, I am sure you must have heard about Public Provident Fund or PPF, one of the most popular long-term saving scheme backed by the government of India. If not about PPF, then definitely about EPF, Employee Pro…

Read more

This month, particularly this week, starting from 18th April was pretty bleak for Indian IT professional looking for migration and an onsite opportunity to Australia, NewZeland, and the USA. Things were not easy from quite some …

Read more

Mandate Holder is a unique facility many private sector banks like ICICI and HDFC bank provides to NRI customers. According to this faculty, NRE/NRO account holder can appoint a resident Indian (a family member only) to manage …

Read more

Should you Invest in FCNR fixed or term deposit? FCNR (Foreign Currency Non Resident) deposit is another way NRI can invest money in fixed deposit, this is the third option for Indians staying abroad along with more popular NRE…

Read more

Yes , you can add any family member or close relatives as a nominee in your NRE account . Almost all the banks, both public sector like SBI, Bank of Baroda and private sector banks e.g. ICICI, HDFC, Axis Bank provides …

Read more

NRE or NRO savings account, which should I open is first doubt comes in mind of any Non Resident Indian (NRI), who wants to open saving accounts in India on Indian banks like ICICI bank, SBI bank, HDFC Bank, Kotak Mahindra Bank …

Read more

NEFT and RTGS are two main ways of electronically transferring money between two banks in India using net banking accounts. Suppose you have a resident, NRI or NRO account from ICICI bank and want to transfer money to your fami…

Read more

Why Invest in NRE Fixed Deposit in India? NRE Fixed Deposit is very hot at this moment with soaring interest rate and very lucrative Exchange rates from USD to INR, SGD to INR and from other foreign currencies. For all those In…

Read more

Recurring deposit for NRI customers NRI recurring deposit is a new investment option offered by many Indian banks like HDFC Bank, SBI, ICICI and Kotak Mahindra, after their successful run with NRI fixed deposit . With almost 25…

Read more

NRIs are always in doubt with taxation and many times they end up by paying double tax on same income, both in the foreign country they are currently working and staying and on India. In order to avoid this double taxation of in…

Read more

An RFC (Resident Foreign Currency) Savings Account is a savings account maintained in foreign currencies e..g USD, CAD, EURO or GBP for NRIs who have returned to India for good but has some foreign currency fund to park. One of…

Read more

If you are an NRI, currently outside India and your passport's expiry is near then you might be thinking about re-issue of passport, but if you are confused between renewal and re-issue of an Indian passport then you have co…

Read more

Yes, NRIs can take personal loans in India, nothing stops them except the bank which are giving Personal loans. Unfortunately, even though, all the public sector banks e.g. SBI, Bank of Baroda, Punjab national bank, private sect…

Read more

In my last post, can NRI invest in National Pension Scheme , I told you that NRIs are now allowed to open NPS accounts , it's time to share more information about NPS like why an NRI should invest in National Pension Scheme.…

Read more

Let me answer the second question first to convince you why a returning NRI would like to find out whether he is a resident or a non-ordinarily reside (RNOR)? Well, there is big tax benefit of filing income tax return in India …

Read more