Do you know that Non-resident Indians can claim a deduction on income from interest on saving bank accounts up to a maximum of 10,000 INR like resident Indians? Well, I didn't. I just come to know about this relatively new tax deduction method. This benefit is provided under Section 80TTA, which is available from the financial year 2012-13. Since an NRI can only have either NRE or NRO saving account, and given interest earned on NRE account is exempted from tax (see here), this will only applicable to interest earned on an NRO saving account.

Note, this is different than interest earned on NRO term deposit, which is liable to TDS @ 30.9%. This deduction is only allowed on saving account balance e.g. you have 2 to 3 lakhs in your NRO saving account which resulted in an interest of around 12 to 15K INR on 4% annual rate.

Note, this is different than interest earned on NRO term deposit, which is liable to TDS @ 30.9%. This deduction is only allowed on saving account balance e.g. you have 2 to 3 lakhs in your NRO saving account which resulted in an interest of around 12 to 15K INR on 4% annual rate.

Btw, this deduction is applicable to any saving account deposit with a bank, co-operative society or post office.

NRIs should also be aware of various tax deductions available under a different section of income tax laws e.g. Section 80C, 80CCC, and 80CCD.

One of the relatively known section is income tax section 80TTA which allow you tax deduction up to 10K INR from your saving account deposit interest.

Here are some important points about section 80TTA for NRIs

1) Like Resident Indians, NRIs can also claim deductions on income from interest on saving bank account.

2) Since NRI can only hold NRE or NRO saving account, and given interest earned on NRE saving account is tax-free, this section effectively applies to only interest earned on the NRO saving account.

3) This tax deduction is only applicable to saving account deposit and not on NRO term deposit which is subject to TDS @ 30.9%. See here to learn more about whether interest earned on NRO fixed deposit is taxable or not.

4) This tax benefit is only available to individual and HUF (Hindu unified family), it's not an application to firm or company.

5) You can claim this deduction if your saving account is with a bank (both public and private sector), a co-operative society, and a post office.

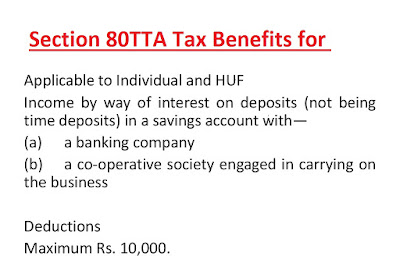

Here is a nice summary of tax benefit offered by section 80TTA for NRI tax payers:

Suppose you have an average balance of Rs2.5 lakh in your savings account during a financial year (on which most banks give interest @4% pa), the interest would be tax-free. This average would be lower if you had a savings account with banks offering higher interest rates. YES Bank offers 6% for balances up to Rs1 lakh and 7% for balances above Rs1 lakh. You can avoid the minimum balance requirement of Rs10,000 for Yes Bank Savings Advantage account by opening an FD of Rs50,000.

That's all about how to save tax up to 10,000 on interest earned on Saving bank deposit in India under section 80TTA of income tax.

Tax Saving deduction 80TTA

If you know, NRIs are required to pay tax on income earned or accrued in India. Since NRI can open and hold NRE and NRO saving account and many of them also earn money on house rentals, interest on NRO fixed deposit and by other means, they also need to plan for tax saving investment.NRIs should also be aware of various tax deductions available under a different section of income tax laws e.g. Section 80C, 80CCC, and 80CCD.

One of the relatively known section is income tax section 80TTA which allow you tax deduction up to 10K INR from your saving account deposit interest.

Here are some important points about section 80TTA for NRIs

1) Like Resident Indians, NRIs can also claim deductions on income from interest on saving bank account.

2) Since NRI can only hold NRE or NRO saving account, and given interest earned on NRE saving account is tax-free, this section effectively applies to only interest earned on the NRO saving account.

3) This tax deduction is only applicable to saving account deposit and not on NRO term deposit which is subject to TDS @ 30.9%. See here to learn more about whether interest earned on NRO fixed deposit is taxable or not.

4) This tax benefit is only available to individual and HUF (Hindu unified family), it's not an application to firm or company.

5) You can claim this deduction if your saving account is with a bank (both public and private sector), a co-operative society, and a post office.

Here is a nice summary of tax benefit offered by section 80TTA for NRI tax payers:

How to save tax under Section 80TTA - Interest earned on Saving Account

Let's see an example of how you can save tax with Section 80TTA.Suppose you have an average balance of Rs2.5 lakh in your savings account during a financial year (on which most banks give interest @4% pa), the interest would be tax-free. This average would be lower if you had a savings account with banks offering higher interest rates. YES Bank offers 6% for balances up to Rs1 lakh and 7% for balances above Rs1 lakh. You can avoid the minimum balance requirement of Rs10,000 for Yes Bank Savings Advantage account by opening an FD of Rs50,000.

That's all about how to save tax up to 10,000 on interest earned on Saving bank deposit in India under section 80TTA of income tax.