One of the important question among Indians going abroad or NRIs returning from overseas to India for a good is to check their residential status to see whether they qualify as an NRI, an RNOR or an Ordinary Indian Resident in the current and future financial years. Why it is important to know the residential status? Well, it's quite important from income tax perspective because if you are an NRI or RNOR (Resident but not Ordinarily Resident) then you don't need to pay tax on your global income, which include interest earned on NRE fixed deposits and FCNR fixed deposit. Instead, you only have to pay tax on income earned in India.

On the other hand, if your residential status is Resident or ROR for a given financial year then you have to pay tax on your global income which includes interest earned on a foreign bank account, dividend received from foreign stock exchanges, and interest earned on NRE and FCNR fixed deposits. Hence, it is quite important to know your actual residential status before filing your income tax return for a financial year.

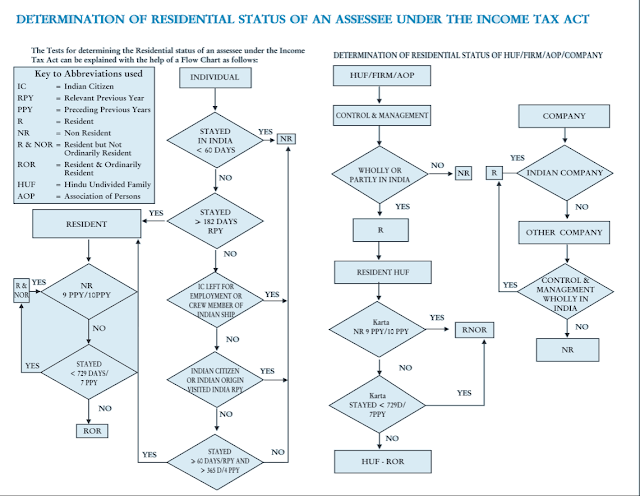

The residential status not just depends on how many days you stays in abroad but also depends upon what is the purpose of your visit, whether you are an Indian citizen and your past stay in India up to previous 10 years. Hence, it's not easy to accurately find your residential status, but you don't have to worry. You can use following flow chart to accurately check whether you are an NRI, an RNOR, or an Ordinary Indian resident.

If you look at the chart, the first question comes to mind is how many days were you in India in a given financial year e.g. FY 201-17 (A Financial year in India starts at 1st April and last till 31st march next year e.g. FY 2016-17 starts on 1st April 2016 and will continue till 31st March 2017).

If you stay in India for less than 60 days in a given year then you are an NRI, no question about that.

If you stays in India between 60 to 182 days then the scenario is bit tricky and it depends on a couple of things e.g. If you are an Indian citizen and went abroad for Employment then you are an NRI but if you are an Indian citizen but didn't go overseas for employment then the next check is how many days you have spent in Indian in last 4 years, if you spent less than 365 days then you are an NRI otherwise you need one more check e.g. Have you been a resident of India in the past 2 out of 10 preceding years, if No then you are an RNOR but if Yes then another check is needed e.g. Have you lived less than 729 days in last 7 years then you are an RNOR, but if you spent more than 729 days then you are an Ordinary Indian Resident.

For Indian software engineers, it's rather easy, if you stays in India between 60 to 182 days in a given financial year but went abroad for Employment then you are considered as NRI.

There are more scenarios if someone stays between 60 to 182 days which will take a look later but let's now consider what if you have stayed more than 182 days in India in a given financial year?

In this case, if you have been an NRI in the past 9 out of 10 preceding years then you are an RNOR (Resident but Not Ordinary Resident) and you can continue to enjoy the tax benefits enjoyed by NRI.

On the other hand if stays in India for more than 182 days and you have also been a resident of India in past 2 out of 10 preceding years then you need to check if you have in India for less than 729 days in last 7 years, if Yes then again you are an RNOR but if not then you are an Ordinary Resident Indian.

Now coming back to stay in India between 60 to 182 days, if you are a foreigner and spent less than 365 days in last 4 years, you are an NRI from tax perspective but if you have spent more than 365 days in last 4 years then we'll go back and check if you are an RNOR. If you have not been a resident of India in the past 2 out of 10 preceding years then you are RNOR. If you have been resident in India for 2 out of 10 preceding years then again you need to check if you have spent less than 729 days in last 7 years, if yes then again you an RNOR, but if not then you are an Ordinary Resident Indian.

On the hand if you are a Person of India Origin (POI) and stays in India for 60 to 182 days then you are considered NRI if you have come to visit India, if not and you came here for employment or job to India then again 365 days check kicks in i.e. if you have stayed less than 365 days in last 4 years then you are an NRI, otherwise RNOR check will kick in as shown in above example.

The chart will really help you to find you actual residential status e.g. if you are an NRI, an RNOR, or an Ordinary Indian Resident for a given financial year. Until you are an NRI or an RNOR you don't need to declare your foreign assets and interest earned on NRE and FCNR account, but once you become ordinary Indian Resident or ROR then you have to declare your foreign bank accounts and global income e.g. dividend earned on stock exchanges abroad or overseas bank fixed deposits etc.

On the other hand, if your residential status is Resident or ROR for a given financial year then you have to pay tax on your global income which includes interest earned on a foreign bank account, dividend received from foreign stock exchanges, and interest earned on NRE and FCNR fixed deposits. Hence, it is quite important to know your actual residential status before filing your income tax return for a financial year.

The residential status not just depends on how many days you stays in abroad but also depends upon what is the purpose of your visit, whether you are an Indian citizen and your past stay in India up to previous 10 years. Hence, it's not easy to accurately find your residential status, but you don't have to worry. You can use following flow chart to accurately check whether you are an NRI, an RNOR, or an Ordinary Indian resident.

If you look at the chart, the first question comes to mind is how many days were you in India in a given financial year e.g. FY 201-17 (A Financial year in India starts at 1st April and last till 31st march next year e.g. FY 2016-17 starts on 1st April 2016 and will continue till 31st March 2017).

If you stay in India for less than 60 days in a given year then you are an NRI, no question about that.

If you stays in India between 60 to 182 days then the scenario is bit tricky and it depends on a couple of things e.g. If you are an Indian citizen and went abroad for Employment then you are an NRI but if you are an Indian citizen but didn't go overseas for employment then the next check is how many days you have spent in Indian in last 4 years, if you spent less than 365 days then you are an NRI otherwise you need one more check e.g. Have you been a resident of India in the past 2 out of 10 preceding years, if No then you are an RNOR but if Yes then another check is needed e.g. Have you lived less than 729 days in last 7 years then you are an RNOR, but if you spent more than 729 days then you are an Ordinary Indian Resident.

For Indian software engineers, it's rather easy, if you stays in India between 60 to 182 days in a given financial year but went abroad for Employment then you are considered as NRI.

There are more scenarios if someone stays between 60 to 182 days which will take a look later but let's now consider what if you have stayed more than 182 days in India in a given financial year?

In this case, if you have been an NRI in the past 9 out of 10 preceding years then you are an RNOR (Resident but Not Ordinary Resident) and you can continue to enjoy the tax benefits enjoyed by NRI.

On the other hand if stays in India for more than 182 days and you have also been a resident of India in past 2 out of 10 preceding years then you need to check if you have in India for less than 729 days in last 7 years, if Yes then again you are an RNOR but if not then you are an Ordinary Resident Indian.

Now coming back to stay in India between 60 to 182 days, if you are a foreigner and spent less than 365 days in last 4 years, you are an NRI from tax perspective but if you have spent more than 365 days in last 4 years then we'll go back and check if you are an RNOR. If you have not been a resident of India in the past 2 out of 10 preceding years then you are RNOR. If you have been resident in India for 2 out of 10 preceding years then again you need to check if you have spent less than 729 days in last 7 years, if yes then again you an RNOR, but if not then you are an Ordinary Resident Indian.

On the hand if you are a Person of India Origin (POI) and stays in India for 60 to 182 days then you are considered NRI if you have come to visit India, if not and you came here for employment or job to India then again 365 days check kicks in i.e. if you have stayed less than 365 days in last 4 years then you are an NRI, otherwise RNOR check will kick in as shown in above example.

The chart will really help you to find you actual residential status e.g. if you are an NRI, an RNOR, or an Ordinary Indian Resident for a given financial year. Until you are an NRI or an RNOR you don't need to declare your foreign assets and interest earned on NRE and FCNR account, but once you become ordinary Indian Resident or ROR then you have to declare your foreign bank accounts and global income e.g. dividend earned on stock exchanges abroad or overseas bank fixed deposits etc.

What are the facilities offered to a returning nre ( rnor, has been continuously maintaining nre status since 2003 )back to India. Is there any tax exemption on interest income from NRE FDs in INR.

ReplyDeleteYou can open RFC account which allows you to keep your foreign funds in tax free manner. I have explained it in more details here

Deletehttp://savingsfunda.blogspot.com/2016/01/why-open-rfc-resident-foreign-currency-account-saving-and-fixed-deposit.html

You can also check my article about what happens to NRE FDs when NRI returns to India