Do I need to Pay Taxes in India When I transfer money from an Overseas bank to India?

Many of my IT friends are working abroad and when you go abroad the first time, you have a lot of queries in your mind, related to NRI status, Taxation in the foreign country, remittance, and Taxation in India. One of the most common questions I see is "Do you need to pay taxes in India when you transfer funds from an Overseas bank to an Indian Saving account?", the short answer is No, provided you are an NRI, I mean you have stayed more than 182 days abroad in that financial year (31st March to 1st April).

Since you have already paid tax on that amount in the country you are earning and currently staying like US or UK, you are not required to pay further tax on the same money, whether you keep them in US Dollars or Indian Rupees; but there are other things to consider.

For example, why do you want to transfer your foreign currency to India? Who holds that saving account etc? The motive is important because it will open more options and I would say better options.

Suppose you want to open a fixed deposit of 10 lacs in India and you transferred that money on your mother's resident saving account ( if you are an NRI you cannot hold a resident saving account in India, you can only hold NRE, NRO, and FCNR accounts) then the interest earned on that deposit will be eligible for taxes and bank will deduct TDS at the rate of 20% if PAN number is not available.

If you open a fixed deposit from funds available in your NRE saving account, all those interests earned will be your gain because no tax will be levied on interest earned in NRE fixed deposit.

Also, don't transfer funds to an NRO account for investment purposes because interest earned on an NRO account is also taxable. NRO account is only to hold your income in Indian rupees, you should only transfer foreign currency converted the amount to NRO if you absolutely need it for some expenditure.

If you are transferring funds from overseas to your parents for their personal expenses, it makes sense to transfer directly to their resident saving account, there won't be any further tax on that amount.

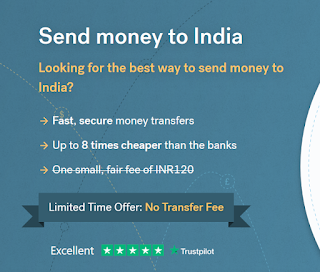

In short, when you transfer foreign currency from abroad to India using remittance services like CurrencyFair, Transferwise, Xoom, Transfast, Remit2India, or MoneyToIndia no taxes are required to pay on that amount if you are NRI if you are not NRI then yes you have to pay tax on your global income but you can always ask for a claim against the tax you paid overseas.

If you are interested to learn more about NRI investments and NRE and NRO accounts e.g. features, benefits, and limitations, you can also check the following article :

P. S. - If you are sending a large amount of money, I suggest you check the CurrencyFair website which generally offers a much better exchange rate, and also the first 3 transfer is free for all new customers. If you want to avail of this here is the link to get the first 3 free transfer money from overseas including the UK, USA, and Australia.

Many of my IT friends are working abroad and when you go abroad the first time, you have a lot of queries in your mind, related to NRI status, Taxation in the foreign country, remittance, and Taxation in India. One of the most common questions I see is "Do you need to pay taxes in India when you transfer funds from an Overseas bank to an Indian Saving account?", the short answer is No, provided you are an NRI, I mean you have stayed more than 182 days abroad in that financial year (31st March to 1st April).

Since you have already paid tax on that amount in the country you are earning and currently staying like US or UK, you are not required to pay further tax on the same money, whether you keep them in US Dollars or Indian Rupees; but there are other things to consider.

For example, why do you want to transfer your foreign currency to India? Who holds that saving account etc? The motive is important because it will open more options and I would say better options.

Transferring Money for Investment

When you are simply remitting money using CurrencyFair, TransferWise, Xoom, or Transfast for investment purposes like for opening a fixed deposit, it's better to open an NRE saving account and then transfer funds there, Why? because interest earned on NRE fixed deposits are tax-free in India.Suppose you want to open a fixed deposit of 10 lacs in India and you transferred that money on your mother's resident saving account ( if you are an NRI you cannot hold a resident saving account in India, you can only hold NRE, NRO, and FCNR accounts) then the interest earned on that deposit will be eligible for taxes and bank will deduct TDS at the rate of 20% if PAN number is not available.

If you open a fixed deposit from funds available in your NRE saving account, all those interests earned will be your gain because no tax will be levied on interest earned in NRE fixed deposit.

Also, don't transfer funds to an NRO account for investment purposes because interest earned on an NRO account is also taxable. NRO account is only to hold your income in Indian rupees, you should only transfer foreign currency converted the amount to NRO if you absolutely need it for some expenditure.

If you are transferring funds from overseas to your parents for their personal expenses, it makes sense to transfer directly to their resident saving account, there won't be any further tax on that amount.

In short, when you transfer foreign currency from abroad to India using remittance services like CurrencyFair, Transferwise, Xoom, Transfast, Remit2India, or MoneyToIndia no taxes are required to pay on that amount if you are NRI if you are not NRI then yes you have to pay tax on your global income but you can always ask for a claim against the tax you paid overseas.

If you are interested to learn more about NRI investments and NRE and NRO accounts e.g. features, benefits, and limitations, you can also check the following article :

- Can NRI invest in Public Provident Fund In India? [answer]

- Can an NRI open more than one NRE account in India? [answer]

- What happens to NRE accounts when NRI returns back to India? [answer]

- Is it mandatory for NRI to file an income tax return in India? [answer]

- Can you transfer money from the NRE account to NRO in India? [answer]

- Can you break FCNR's fixed deposit before maturity? [answer]

- What is the difference between NRI, NRO, and FCNR accounts? [answer]

- How to deposit money on NRE and NRO accounts in India? [answer]

P. S. - If you are sending a large amount of money, I suggest you check the CurrencyFair website which generally offers a much better exchange rate, and also the first 3 transfer is free for all new customers. If you want to avail of this here is the link to get the first 3 free transfer money from overseas including the UK, USA, and Australia.

Hi , My friend worked in abroad and come back to 2014 but he kept his savings money in his overseas bank. He want to take that money back to India now. Is this amount is taxable and the new law impact his money?

ReplyDeleteHi, the earnings your friend has in his overseas account was already taxed in that country. So, for bringing the money to India now, he will not have to pay additional tax. Which country is he bringing the money from?

DeleteMy mother's income is less than 2.5 lakhs/year. So can I send her some money to deposit as FD? Will that attract any taxes?

ReplyDeleteNo, i guess you don't have to pay tax on you money transfer to India. You have already paid tax on you earnings. Many online remittance services offers free remittance to India.

ReplyDeleteHii.. i am working in dubai. My query is if i transfer money from my ADCB a/c to axis bank NRE a/c as foriegn currenty is it taxable ..

ReplyDeleteNO

DeleteI am an Australian lending money to a friend in India to acquire a house. There is a loan document and the funds are repayable. Will he need to pay tax on this loan?

ReplyDelete@Anonymous, I am not the expert on that but my understanding is that loans are not considered income hence he don't need to pay tax, but you better ask him to check with a certified charted account or income tax planner.

DeleteOn 1st September 2016, I left India and came to Ireland to pursue my masters. As part of teaching assistant job, I got paid some money into a local Irish bank account. In May 2017, I joined an internship here, for which I got paid monthly salary into the local Irish bank account. However, now I am planning to return to India permanently. I'll reach back on 1st September 2017. I have a normal savings account (neither NRO nor NRE) in HDFC bank. If I transfer money from my Irish account to that account in India, will it be taxable? I have already paid taxes to the Irish government. What's the right thing to do here? Also, my parents had sponsored my tuition and living by loading money to an indian forex card. I used that to pay off deposits for my accommodation here, however, I've gotten the deposit back in my Irish bank account as well. How can I show that this money is not income? I have payslips for all my earnings.

ReplyDeleteHello Shruti,

DeleteSince, you went on 1st September 2016, you have stayed for 212 days outside in India in financial year 2016-17, which means you will be considered an NRI for that year from income tax perspective. What this means is that, you don't need to pay income tax on your global income in India. Only income earned in India will be taxed.

This means you can transfer the money to India without worry e.g. in your account or your parents account. By law, an NRI cannot keep normal saving account, it must be either NRO or NRE, but since you are already coming back, its up to you. You also have option to transfer the amount to your parents account because it will be considered gift and will not be taxed.

hello,

ReplyDeletei am resident of india,having salary account in hdfc bank.In between i got an opportunity to work abroad and the money got deposited to my account as remittance,i stayed for more than 6 months but did not convert my hdfc salary account to nre/nro etc.may i please know whether i need to pay tax on this remittance deposited to my account?if yes can i get this remittance to be deposited in my brothers account who is holding an nri account to prevent taxes in future remittance?kindly advise

Hello Shek, You first need to check whether you are an NRI for that financial year or not. You can see this article to calculate your residential status.

DeleteIf you are NRI, then you don't need to pay tax on your foreign income but if you are not then you have to pay tax on that income.

If your brother has NRO account, you can deposit money to his account, but not on NRE Account because you cannot deposit INR on NRE account.

Btw, this will not do any good, you still have to pay tax on your income.

I am holding an NRE account in India. I tried to get a property from the money i earned for 5 years in USA. I gave 50% of the money to the construction company from my NRE Account and the deal did not went through. now i have that money in my saving bank accounts. How can it claim that as this is a tax paid money ? how can i move it back to NRE account ? FORM 15 CA CB can be claimed only for indian tax paid money. Any advise is helpfull.

ReplyDeleteHello Unknown, I answered a similar questions here, please check there https://savingsfunda.blogspot.sg/2017/04/can-you-transfer-money-from-nre-to-NRO-FCNR-Resident-Saving-Account.html?showComment=1509787820969#c5848638247164521372

DeleteHi Javin,

ReplyDeleteI need to send money to one my family member in india through bank transfer. It is a gift for his marriage. I am not indian and I live in France. Would this amount would be taxable to him? He is my uncle..

Thanks in advance

Hello Anonymous,

DeleteIt depends upon the amount you wish to gift. As per the Income Tax Act, 1961 if the value of gifts received is more than Rs. 50,000 a year, then such amount is taxed as income in the hands of the receiver. These gifts may be in any form – cash, jewellery, movable and immovable property, shares etc.

Btw, if he is relative as you mentioned then he don't need to pay tax, provided your relation comes under following category:

Following is the list of relations which are considered as “relatives” for gift purpose where income tax is not required

Your spouse

Your brother or sister

Brother or sister of your spouse

Brother or sister of either of your parents

Any of your lineal ascendants or descendants

Any lineal ascendant or descendant of your spouse

Spouse of the persons referred in above points

Do we need to take any prior or post approval from Reserve Bank of India for bringing the balance funds lying in the German Subsidiary Bank Account to India / Closure of the Subsidiary

ReplyDeleteSir,

ReplyDeleteI earned about 1.5 million US dollars from Foreign based binary options. I live in India. If I withdraw money into my saving account will it be taxable ?

1.5 million USD ... WOW :-) First of all congratulations for making a fortune with binary options. Since you are an Indian citizen your global income will be taxed in India, hence you are liable to pay tax on this earning as well.

DeleteHello,

ReplyDeleteOne of my in laws wants to send money from UK to my bank account in India in pursue of future shopping for my wedding.

Can he do that? Will be the amount taxed ? What does he need to declare?