Can we withdraw money from the PPF account before maturity? One of the most common questions people ask before opening a PPF account is "can we withdraw money from a PPF account before maturity?" . One reason for this…

Read more

If you are an NRI (Non-Resident Indian) then you have access to a unique bank account called NRE (Non-Resident External) account which allows you to keep your money in Indian rupees. This account then further allows you one of …

Read more

ELSS (Equity Linked Saving Scheme), PPF (Public Provident Fund), NSC (National Saving Certificate), and Tax-saving fixed deposits with banks are four of the most popular way to save tax under section 80C , but which one is the …

Read more

NRIs are allowed to buy and sell properties in India, and they can also bring the profit post-sale of their property abroad, but there are a couple of things which you need to learn and remember. For example, you need to know t…

Read more

Yes, NRI can now invest in NPS or National Pension Scheme in India . Recently, on July 2015, PFRDA, the Pension Regulator has clarified that Non Resident Indians (NRIs) can invest in National Pension Scheme (NPS) to save for the…

Read more

This is one of the most frequently asked questions among Singapore NRI community. I often receive queries from IT professionals working in the city-state who have home loans back in India and thinking to pay off in full or a por…

Read more

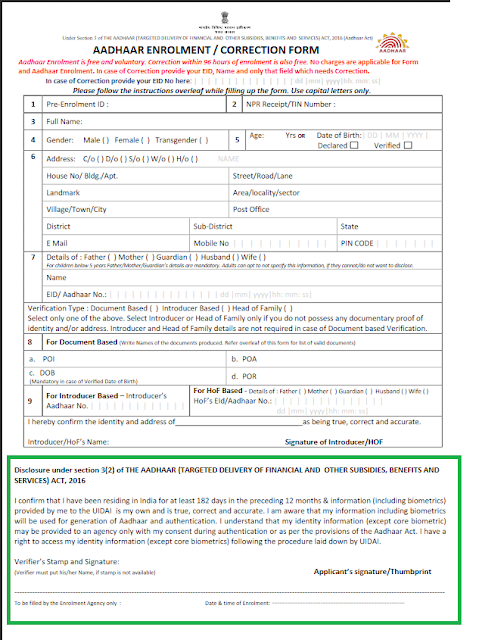

Ever since the income tax department of India made it mandatory to linked PAN card to Aadhaar card and ask every taxpayer to quote Aadhaar card number into the income tax return, many NRIs become worried. The reason was simple, …

Read more

I was searching for good health insurance plans for my family recently when I come to know about these "family floater health insurance plans". I have not heard this term before, so I did a bit of research about family…

Read more

As an India citizen, it's important for an NRI to know it's rights and responsibilities, especially about finance, tax, banking, and investments. When I first moved abroad I have absolutely zero knowledge of any of these…

Read more

People often mistook Public Provident Fund or PPF for Employee Provident Fund or EPF, though both are provident fund and backed by the government of India, they are independent of each other. The main difference between PPF and …

Read more