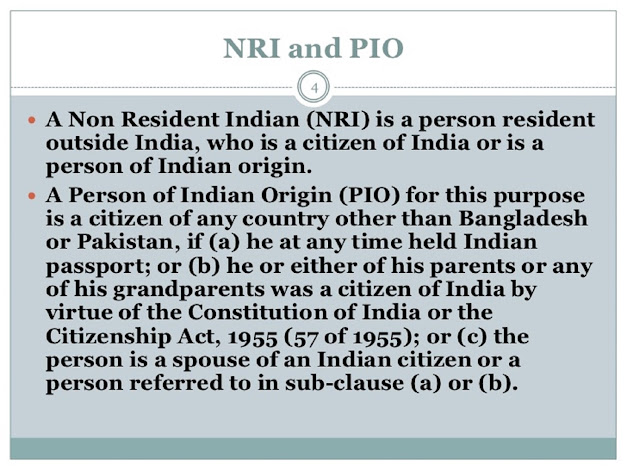

3 Best bank to open SGD/HKD NRI or FCNR Fixed Deposit? DBS vs ICICI

If you are living and working in Singapore or Hong Kong and thinking to open FCNR (Foreign currency Non-resident) fixed deposits in Singapore and Hong Kong dollar i.e. SGD or HKD then, unfortunately, you don't have many choi…