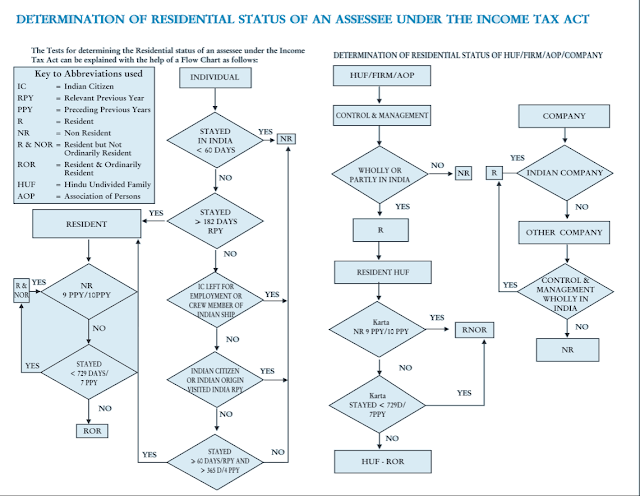

One of the important question among Indians going abroad or NRIs returning from overseas to India for a good is to check their residential status to see whether they qualify as an NRI, an RNOR or an Ordinary Indian Resident in …

Read more

One of the most frequently asked question among NRI community post the historic announcement of demonetization of Rs 500 and Rs 1000 notes in India is whether NRIs can send the Indian currency to India using FedEx, DTDC or DHL e…

Read more

One of the important detail many NRIs ignore while opening NRE or NRO saving account is the minimum account balance required to be maintained on the monthly or quarterly basis. Sometimes this is also known as average monthly b…

Read more

Nowadays, opening an NRE or NRO account from overseas has become quite easy with an online application form and free pickup services offered by many Indian public sectors and private sector banks. Almost all major banks includi…

Read more

In the last couple of articles, I have told you why health insurance is important for parents and what are the tax benefits you get by buying health insurance for your family and parents ( see here ), but I have not shared any …

Read more

If you have been filing your income tax returns in India then you know that there are a lot of tax saving options you can use to claim tax deductions and exemptions under a various section of income tax law of India. For examp…

Read more

In last article, I told you that you can use the DTAA (Double Tax avoidance Agreement) to prevent double taxation of same income in two countries. Since most of the NRI pay their taxes in their country of employment or residen…

Read more

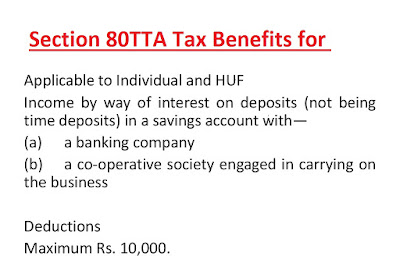

Do you know that Non-resident Indians can claim a deduction on income from interest on saving bank accounts up to a maximum of 10,000 INR like resident Indians? Well, I didn't. I just come to know about this relatively new t…

Read more

Recently one of my friend, working for an IT company in the USA on H1B visa received notification from Indian banks and Mutual funds that he needs to submit FATCA compliant certificates. He wasn't sure about what is FATCA …

Read more

Since the last date of the financial year 31st, March is approaching, many Mutual funds, brokerage house, and Insurance companies are aggressively promoting their products in a bid to attract income taxpayers who like to save ta…

Read more

Many Indians who goes to work abroad for work opens NRE saving and NRE fixed deposit account to take benefit of higher interest rate and absolutely no tax on interest earned on those account, but do you know what happens to your …

Read more

One of the most important and controversial points of the recently concluded Indian budget 2016 is the taxation on Employee Provident Fund withdrawals. Earlier, similar to PPF , EPF was also completely tax-free, i.e., whatever a…

Read more